Consumer sentiment toward Anheuser-Busch InBev’s (A-B) Bud Light continues to decline more than a year after the initial boycott of the brand, according to a HundredX survey, shared by Goldman Sachs in its latest Beverage Bytes report.

HundredX, a “mission-based data insights company,” analyzed consumer opinions of top beer brands from March 2023 to March 2024. The firm measured customer loyalty by how likely a respondent was to recommend a brand, which determined the brand’s Net Promoter Score (NPS). Scores range from -100 to +100, with higher scores indicating more positivity.

Bud Light’s NPS sharply declined in April 2023, following a conservative-led boycott of the brand after a social media ad by influencer Dylan Mulvaney, a transgender woman. The brand’s NPS declined from around +30 in March, to lower than -40 in July.

Bud Light’s NPS started improving over the summer, consistently recording month-over-month (MoM) growth. However, in February, sentiment began to “erode” again, and Bud Light ended March with an NPS of -35.7, according to Goldman Sachs analyst Bonnie Herzog. The decline is in spite of some improvements at retail, according to Goldman Sachs’ most recent retailer survey, which found that A-B was “doing a better job than many expected.”

Consumer sentiment for the “broader Bud franchise” is improving, with an NPS score around -10 over the last three months. The brand family’s lowest NPS reached -30 in July 2023.

Meanwhile, brand equity for Molson Coors’ Coors Light is strengthening, “with more consumers likely to recommend the brand today versus last year,” Herzog wrote. In March, Coors Light had an NPS of +38.6, and has remained at +30 or above since May 2023. Miller Lite has had a similar NPS over the past three months (+36), but is a few points below where it was in March 2023. Both brands recorded MoM increases from February to March.

Constellation Brands’ Modelo and Corona brand families are also seeing increases in consumer sentiment, and are growing off higher bases than Molson Coors brands. Modelo (+53.9) had the second highest March rating among the 15 brands observed by HundredX, below only Guinness (+54.5), which benefited from St. Patrick’s Day. Corona ranked No. 4, with a NPS of +45.6, below Molson Coors’ Blue Moon (+46).

All other brands remained in the positive, including:

- Boston Beer Company’s Samuel Adams (+44.6);

- A-B’s Stella Artois (+44.4);

- A-B’s Michelob Ultra (+44.2);

- Heineken’s Dos Equis (+40.7);

- Heineken brand (+33.8);

- A-B’s Presidente (+26.3).

HundredX also reported Net Consumption Intent (NCI) scores, measured on the same -100 to +100 scale. Bud Light had an NCI of -35.7 in the three-month period through March, while the Bud family had a score of -11. All other brands observed by HundredX had scores above zero.

When comparing quarter-over-quarter, Bud Light’s NCI declined -44.8% and Bud’s NCI declined -32.9%, the only double-digit declines of the 15 observed brands. However, all other brands except for Guiness (+3.1%) were “unsurprisingly subdued” and in decline, “reflecting the category’s secular decline in popularity,” Herzog wrote.

When compared to March 2023, the March 2024 NCI for Bud Light declined -33.4% year-over-year (YoY), while the NCI for the Bud family declined -22.9%. Presidente (-5.2%), Miller (-3.5%), Dos Equis (-1.6%) and Blue Moon (-0.5%) also declined YoY.

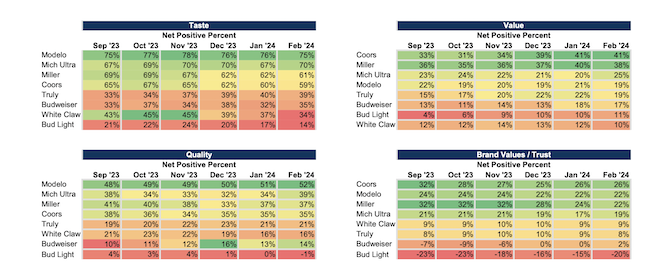

Consumers were also asked to score brands based on “key performance indicators” (KPIs), including taste, value, quality, brands values/trust, flavors, product availability, convenience, ads/commercials, price and coupons/promotions. Brands were then ranked by net responses, with positive percentages indicating higher positive responses, and negative percentages indicating higher negative responses.

Eight brands were included in HundredX’s rankings, including Coors Light, Miller Lite, Michelob Ultra, Modelo, Budweiser, Bud Light, and two hard seltzer brands: Boston Beer’s Truly and Mark Anthony Brands’ White Claw.

Miller Lite and Coors Light “most consistently scored in [the] top three across key KPIs,” Herzog wrote. As of February, Coors had the highest net positive response for value (41%), brand values/trust (26%) and price (43%), and was in the top three for flavors (24%) and ads/commercials (19%). Miller Lite was No. 1 for product availability (64%) and in the top three for taste (61%), value (38%), quality (37%), brand values/trust (22%), ads/commercials (18%) and price (41%).

Modelo was No. 1 for taste (75%), quality (52%), flavors (40%) and ads/commercials (20%). The brand family maintained or increased its percentage in net positive responses over the past six months for all four categories. It also ranked among the top three for brand values/trust (22%).

Michelob Ultra also consistently posted positive KPIs, ranking among the top three for taste (70%), value (25%), quality (39%), flavors (25%), product availability (62%) and convenience (54%).

Bud Light was No. 1 for coupons/promotions, leading a list of brands with net negative responses (-7%). It also made the top three for price (25%). Bud Light ranked last of the eight brands listed for taste (14%), quality (-1%), brand values/trust (-20%), flavors (6%), product availability (40%), convenience (31%) and ads/commercials (-18%).

White Claw took last place for the three remaining KPIs – value (10%), price (3%) and coupons/promotions (-19%) – but ranked among the top three for product availability (59%) and convenience (52%).