Despite industry scan trends, Firestone Walker believes “the American craft beer industry is as strong as ever.”

The Duvel-owned California craft brewery is focused on its core beer brands in 2025, and believes those brands can satisfy both classic craft beer consumers and new drinkers, leadership detailed Monday in a virtual presentation for wholesale partners.

“Due to the way the industry is rolling, we’re doing a lot of just looking inward, doing a lot of tweaking – the process is always evolving – and making sure that we’re keeping up with all there is on the technical side of brewing,” Firestone Walker brewmaster Matt Brynildson said.

“We live in a time that craft has never been more exciting, and yet, beer is an ancient art, and it’s something that is always here to stay,” he continued.

Firestone Walker leadership’s comments echoed sentiments shared by Sierra Nevada leaders during their own wholesale meeting last month, emphasizing the importance of supporting craft beer.

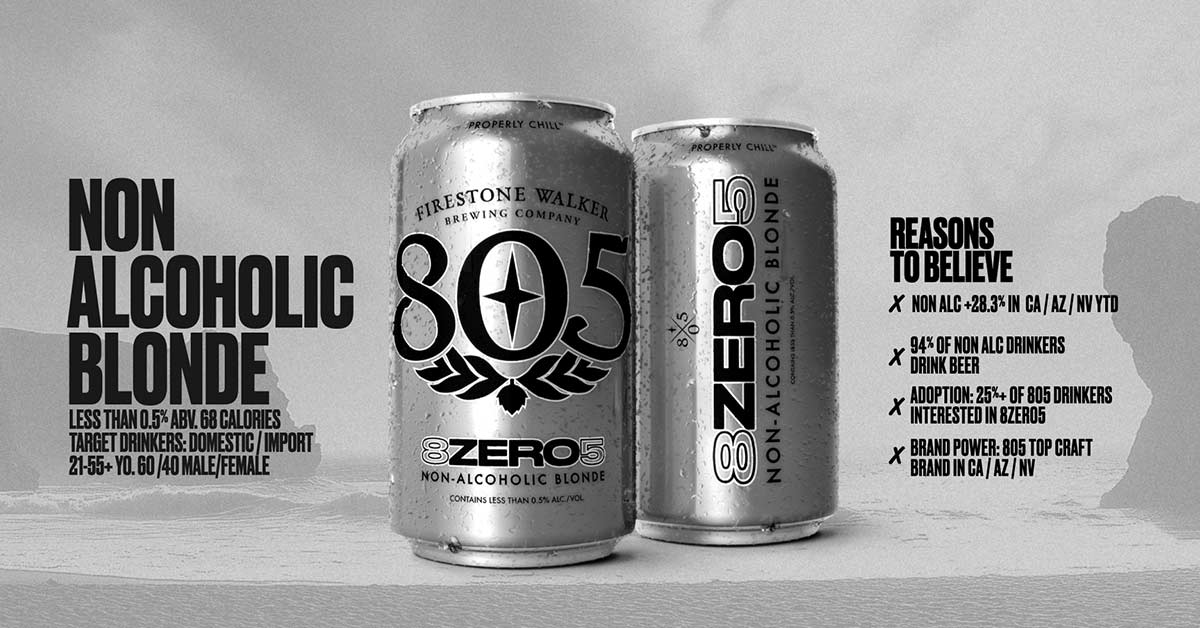

Leading Firestone Walker’s portfolio and 2025 strategy is its flagship 805 brand family, including 805 Blonde, 805 Cerveza (a Mexican-inspired light lager, launched in 2021) and 8ZERO5 non-alcoholic (launched earlier this month).

The company’s goal is to build “the legend” of the brand, which it sees as “more than a beer,” and rather “a movement” and a lifestyle, represented by its brand ambassadors, including athletes and artists. The idea is being supported by new brand campaigns and short films.

Firestone Walker’s No. 1 brand 805 Blonde (4.7% ABV) has outpaced No. 2 805 Cerveza (4.5% ABV) by more than 3X in NIQ-tracked off-premise channels year-to-date (YTD), through August 10. However, Cerveza has increased both dollar sales (+7%) and volume (+4.8%) YTD, while 805 Blonde is in the red (dollar sales -2.1%, volume -4.3%).

In the last four weeks, 805 Blonde dollar sales (-7.3%) and volume (-10.9%) both declined year-over-year (YoY), while 805 Cerveza dollar sales increased +2.5% and volume was nearly flat (-0.3%).

“Craft is dead, or so they say,” CMO Dustin Hinz said. “We’ve heard the skepticism and the doomsayers, and while trends come and go, we’re here to tell you that we believe the American craft beer industry is as strong as ever.”

“When the industry is tough, the metric that we like to look to is really share gain,” CEO Nick Firestone told Brewbound in a roundtable discussion following Monday’s presentation.

Despite declines, 805 Blonde has maintained share of total beer in NIQ-tracked off-premise channels (0.15%). The offering is also the No. 1 craft beer brand in California and Nevada, and No. 3 in Arizona – Firestone Walker’s top three markets, the company shared, citing NIQ data through July 13. 805 Blonde is also the No. 13 largest beer brand in the three states, with no other craft brands cracking the top 20.

805 is distributed in 16 states, with no immediate plans to add additional states in 2025. Instead, the company is focused on deepening its existing footprint.

“Looking at the room for distribution growth in our footprint, we believe we can easily double our business,” chief sales officer Tony Amaral said.

The company is also prioritizing the on-premise, particularly expanding 805 Cerveza and 8ZERO5 in the channel and creating a “trinity of distribution,” Amaral said, noting that 805 Cerveza should be on draft or in bottles everywhere 805 Blonde is.

“We want to make sure all consumer demand is met with those three SKUs,” Amaral told Brewbound. “We at Firestone Walker still believe that brands are built in the on-premise, and it’s still an important piece of the business.”

About 35% of Firestone Walker’s total business is in the on-premise, and 805 Blonde is the No. 1 draft brand in the company’s portfolio, followed by Cali Squeeze, its fruit-flavored wheat beer.

Amaral said the option of having 805 Cerveza in bottles is helping expand the offering’s presence in on-premise accounts. The “challenge” he sees moving forward is “convincing retailers” why they should expand their non-alc (NA) menu with 8ZERO5. Firestone Walker’s rebuttal is that 60% of 21-35 year-olds have “never had craft,” and 8ZERO5 provides an opportunity to bring new consumers into craft beer.

8ZERO5 also gives existing 805 fans another occasion to drink the brand they’re familiar with, and gives NA consumers a chance to be a part of the 805 lifestyle, Hinz told Brewbound.

“Non-alc is about expanding the occasions for beer, not demonizing it,” he continued. “Beer is here to stay, and 805 is how we give drinkers more choice in an unparalleled brand package.”

805 Able to Compete With All Beer, Including Light Lager Boom

Numerous craft brands have released lagers in the past year to capitalize on changes in the domestic beer market, increasing competition for the 805 brand family. While Firestone Walker leadership acknowledged the increasingly crowded market, they expressed their confidence in their brand maintaining share and growth.

“The versatility of 805, it competes with beer, it doesn’t just compete in the [craft] category within beer,” Amaral told Brewbound. “It’s pretty versatile.”

“A lot of brands went all in, and there’s a couple of ones out there that have done a good job with positioning, but they’re already moving on to different things,” Hinz said. “New brands take a long time to build, and doing [Cerveza] as part of the 805 model allowed us to expand what 805 meant and who it could reach.

“At the end of the day, customers are as loyal as your distribution and your product offering,” he continued. “And if customers are reaching for Mexican-style beer, 805 feels like it can credibly own this, because in our home state, 40% of our population is Hispanic, we feel like we could credibly make this beer [and] position it the way that we did.”

“[With] plenty of new faux-stalgia brands hitting the market, it’s important to remember that Firestone actually has an authentic heritage story that resonates with customers,” brand director Hannah Barnett added.

Firestone Brand to Satisfy Needs of Most Dedicated Craft Consumers

Firestone Walker plans to continue to cater to craft’s most dedicated consumers with its Firestone brand (F Brand), led by its Beer Before Glory mixed pack, the No. 2 assorted craft brand in California, Arizona and Nevada, according to Barnett.

The variety 12-pack – available in cans and bottles – includes Luponic Distortion IPA (5.9% ABV), Firestone IPA (6.5% ABV), Union Jack IPA (7% ABV) and Hopnosis IPA (6.7% ABV). The latter will be replaced with pack-exclusive Firestone XPA (5% ABV) in 2025, with all package offerings of Hopnosis pulled from distribution. Luponic Distortion will also be reformulated with a new hop combination in 2025.

“In a sea of weird beers with silly names that no longer resonate with the craft consumer, this pack stands out as a premium heritage modern craft beer brand,” Barnett said. “With craft beer in general coming in at a more premium price point. This premium look and feel serves as a reminder of the quality of the beers and the passion and expertise that goes into creating them.”

Barnett also highlighted growth from DBA double barrel ale (5% ABV) and Pivo American pilsner (5.3% ABV), which are a part of The Lion & Bear Collection, along with Union Jack, with the trio thought of as “the beers that built the brewery,” Barnett said. DBA has increased dollar sales +10% YTD, while Pivo is up +39%, according to Barnett.

Along with limited seasonal releases, the company will also continue to offer exclusive beers through its Brewmaster’s Collective.

“We won’t burden our network with these small batch artisan beers,” Barnett told wholesalers. “However, we want you to know that we’re invested in keeping drinkers craft curious.”

“It’s important to remember that what we’re seeing today in craft specifically has happened twice before,” Amaral said. “Consumers came back in a big way both times, and we believe they will again.

“Those legacy brewers in the past never gave up in the space while evolving their business, they – Firestone Walker included – stayed true to the core of craft and gave consumers a safe space to continue to explore in flavor,” he continued. “More now than ever, we owe it to the industry to be good stewards of beer, and we believe the Lion and Bear brands can help do that.”

Brewbound previously covered Firestone Walker’s plans for its Cali Squeeze and Mind Haze brand families. Insiders can read the full story, including details on new beer-focused innovations intended to draw in younger legal-drinking-age consumers and flavored malt beverage and canned cocktail fans.