In the thick of the summer selling season, Duvel Moortgat USA is taking its Boulevard Brewing Company and Brewery Ommegang brands in differing directions.

Earlier this month, the company launched the Quirk Spiked & Sparkling line of hard seltzers under the Kansas City, Missouri-based craft brewery’s Boulevard Beverage Company “side hustle,” a follow up to last year’s launch of the Fling line of ready-to-drink (RTD) canned cocktails.

Meanwhile, sister brand Brewery Ommegang in Cooperstown, New York, is building around its 2-year-old Neon Rainbows New England-style IPA, which is now a year-round offering.

In a conversation with Brewbound, Duvel Moortgat USA VP of sales Bobby Dykstra and VP of marketing Natalie Gershon discussed plans for the Boulevard and Brewery Ommegang brands, trends during the COVID-19 pandemic and their strategy for the next six months.

The Quirk hard seltzer line is off to a fast start, selling out in the Kansas City area during its launch week. Dykstra said the brand is beating initial projections of 50,000 cases for the year and could possibly double or triple that figure.

With Quirk, Boulevard is focusing on its traditional Midwestern markets, beginning in Oklahoma and moving north.

“We wanted to ship Boulevard seltzer where Boulevard has great brand awareness, fantastic trade relationships, really strong retailer support,” Gershon said.

Both Dykstra and Gershon touted the up-sell opportunities for wholesalers and retailers. Quirk’s three flavor combinations — Strawberry Lemon and Basil, Blackberry Sage, and Pear Yuzu — are sold in single-flavor 6-packs at a suggested price of $9.99, about a dollar more than the top-selling seltzer brands.

“We really honed in on these unique flavor combinations with a little bit of real fruit juice, and we were able to deliver this beautiful, amazing, more robust taste, but still hit all the metrics that a seltzer drinker is looking for: 90 calories, no sugar, low-carb, really crushable, with a little bit more than you expected,” Gershon said.

Asked why Boulevard is deviating from the variety pack model — which are the top-selling package types for category leaders White Claw (Mark Anthony Brands) and Truly (Boston Beer Company) — Dykstra said the company wanted to establish each flavor individually and give its wholesalers and retailers a higher-margin product.

“We think that there is an up-sell opportunity in the seltzer category, and that people will pay for flavor and a little bit more dynamic flavor combinations like we’re delivering,” he said.

A lot is riding on Quirk. Dykstra is optimistic that Boulevard can return to growth in 2020, if the hard seltzer brand’s sales trends continue, along with those of other core offerings in off-premise retailers continue. The company’s volume trends have declined in each of the last four years since hitting a peak of 196,000 barrels in 2015. In 2019, the company produced 156,000 barrels, a decline of 3%.

Quirk joins a list of priority brands for Boulevard that includes Fling, which has increased sales 30%, cycling last year’s brand launch, as well as beer brands Wheat, Tank 7 and Space Camper IPA.

Dollar sales trends of Boulevard’s year-round core offerings have accelerated during the COVID-19 pandemic and consumer stock up, including Wheat (+15%), Pale Ale (+9%), Tank 7 (+28%) and Space Camper IPA (+40%).

On-premise sales accounted for about 36% of Boulevard’s total business, with sizable business at the Kansas City Royals’ home stadium, Kauffman Stadium, and a focus on third-spaces. Among the most challenged brands is flagship Wheat, which while in the black in off-premise retailers, has too big of a hole to dig out of overall, Dykstra admitted.

“We can’t fully dig out of that challenge, especially when you think about Kauffman Stadium, of our couple hundred handles, that that’s a big one,” he said.

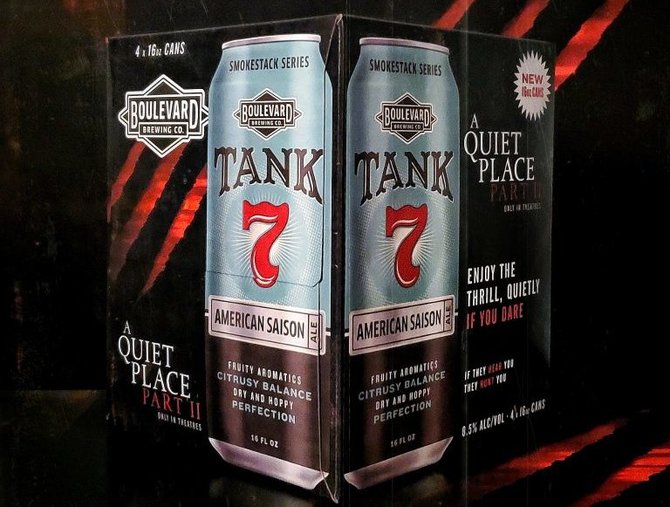

Driving the growth for Tank 7 saison is the addition of can packaging for the first time, as 16 oz. 4-pack cans were added about four months ago as part of the promotion for A Quiet Place 2, which was slated to premiere in the spring but was postponed due to the pandemic until Labor Day weekend. Gershon added that Boulevard’s promotion of the horror sequel will carry over to its new release date.

The addition of can packaging has been incremental for the brand, as bottles continue to outsell cans three-to-one, Dykstra said.

Meanwhile, at Brewery Ommegang, Dykstra said the focus is on creating building blocks for the future, centered around the 2-year-old Neon Rainbows, which is on pace to be the New York craft brewery’s top-selling brand in 2020. The company’s volume, which declined an estimated 14% in 2019, to 31,000 barrels, is expected to decline in 2020, between the loss of the Game of Thrones series of beers and the pandemic. About 40% of Brewery Ommegang’s total sales flow through bars and restaurants.

“We’re a brewery there that doesn’t have a lot of IPAs, and that’s 30-some percent of the business,” Dykstra said. “So probably not a crazy idea that an IPA would be your No. 1 brand, but coming from a Belgian-centric brewery, that’s new news.”

In addition to Neon Rainbows, Brewery Ommegang will build around Idyll Days pilsner. However, the brand’s launch was hampered by the loss of spring resets due to the novel coronavirus.

Sales of Three Philosophers Belgian quadrupel, which has added 16 oz. can packaging, are down 6%, which Dykstra said is an improvement upon previous trends.

Brewery Ommegang president and general manager Doug Campbell exited the company in April; the company is exploring options for a replacement.