Twisted Tea accounts for the majority of Boston Beer’s volume and has become the company’s “only meaningful source of growth,” Bernstein analyst Nadine Sarwat wrote in a report focusing on the brand’s sustainability.

Growth of Twisted Tea volume has decelerated to +10% year-over-year (YoY), compared to +35% at this time last year. Against the backdrop of rising competition in the hard tea segment, a cooling off period for Twisted Tea could spell trouble for Boston Beer.

Through a forecast model examining total distribution points and state-level per capita data, Sarwat estimates Twisted Tea can deliver a +9% compound annual growth rate (CAGR) over the next five years – with some caveats.

“This assumes that Boston Beer prioritizes long-term sustainable brand health over short term volume gains (i.e. excessive flavor and pack innovation over a short period of time),” she wrote. “Given that Twisted Tea is Boston Beer’s only growth brand amidst a sea of declining ones (especially Truly), one could question how likely this is.”

Chasing volume through nonstop innovation was a strategy Boston Beer leadership has admitted the company has overdone in the past. Boston Beer introduced four line extensions of Truly Hard Seltzer between 2020 and 2022. They included Lemonade, Iced Tea, Punch and Margarita, which were all incremental to its core fruited seltzer packs, Berry, Citrus and Tropical.

“We got in this innovation cycle where we were adding a lot of new variety pack SKUs,” then-CEO Dave Burwick said during the company’s Q3 2023 earnings call. “And at some point, you just have to walk away from that and you have to find a way to do more with fewer, and that’s part of the plan for next year.”

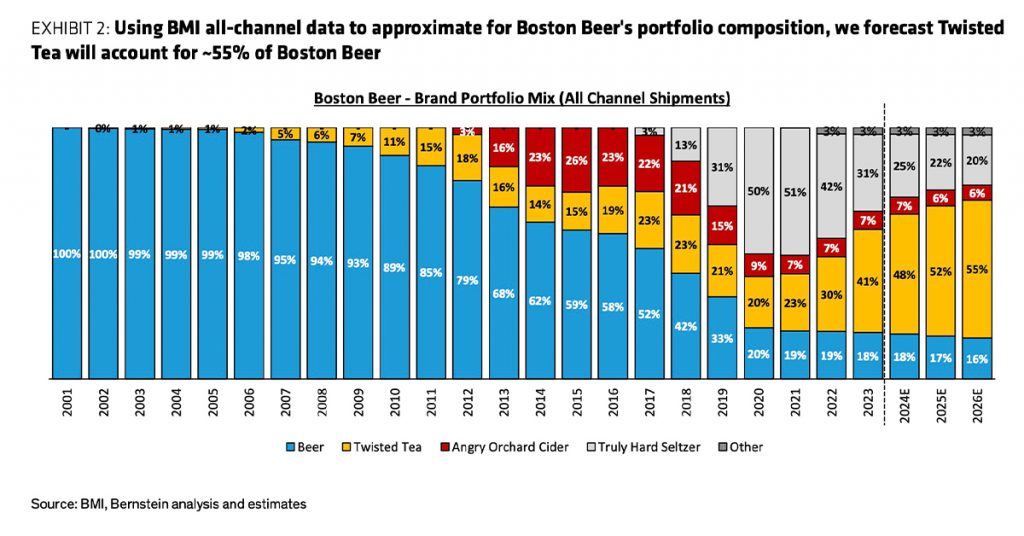

Truly’s share of the company’s shipment volume (sales to wholesalers) peaked at 51% in 2021, but dropped to 42% in 2022 and 31% in 2023, according to Bernstein analysis of data from Beer Marketer’s Insights. Bernstein estimates the hard seltzer will account for 25% of the company’s shipment volume in 2024.

In Boston Beer shipments, Twisted Tea’s share was 20% in 2020, 23% in 2021, 30% in 2022 and 41% in 2023. Bernstein projects that it could reach 55% of total company shipments in 2026.

Nearly all of Truly’s lost internal shipment volume share has gone to Twisted Tea, which the company has approached very differently than Truly in terms of innovation. Twisted Tea’s portfolio is heavily skewed toward its flagship Original, with Half & Half and the core variety pack tied for a distant second. There are only two variety packs under the brand, as opposed to Truly’s six.

Original accounted for 41.35% of the $1.248 billion Twisted Tea sold at total U.S. xAOC (extended all outlets combined, which includes grocery stores, drug stores, mass retailers, dollar stores, club stores and military outlets) + liquor + convenience stores in the 52-week period ending June 15, according to market research firm NIQ. Half & Half was less than half that share (20.56%), followed by the core variety pack (20.15%). All other Twisted Tea offerings – which includes Twisted Tea Light, Twisted Tea Light variety pack, two flavors of Twisted Tea Extreme, and various fruited flavors – accounted for 17.94% of the brand’s dollar sales in the period, according to NIQ data.

Of the brand’s top three SKUs, the variety pack has recorded the strongest growth in dollar sales (+52.8% year-over-year) and volume (+48.4% YoY), followed by Half & Half (+22.2% in dollars, +18.2% in volume) and Original (+7.6% in dollars, +4.1% in volume).

Last year, Twisted Tea shipped 3.150 million barrels of product, according to Bernstein. It crossed the million-barrel mark in 2019 and has increased shipment volume +472% since 2013, when it shipped 550,000 barrels.

In NIQ-tracked channels, which isn’t a perfect analog to shipments, Twisted Tea accounts for 57% of Boston Beer’s volume – far outpacing its siblings Truly (27.5%), Samuel Adams (6.6%), Angry Orchard (6%) and the rest of the company’s portfolio (2.9%), which includes Dogfish Head, Hard MTN Dew and Jim Beam Kentucky Coolers.

Nearly two years ago, Twisted Tea held a 91.8% share of the hard tea segment in NIQ-tracked channels, according to Bernstein. Between August 2022 and June 2024, the brand lost -7.3% in share, as three newcomers captured 7.1% of the segment: AriZona Hard Iced Tea (3.7%), Kirin-owned New Belgium Voodoo Ranger Hardcharged Tea (2.2%) and Monster’s Nasty Beast Hard Tea (1.2%).

In the period, Molson Coors’ hard tea offerings’ share dropped -1.3%, to 4%. The company’s tea portfolio includes Arnold Palmer Spiked, which it launched in 2018 in partnership with AriZona, and Peace Hard Tea, which it launched in 2023 in partnership with Coca-Cola.

All other brands in the malt-based hard tea segment increased share from 2.9% in August 2022 to 4.5% in June 2024, according to Bernstein.

“Taken together, from its 5-year peak of ~93% market share in April 2023, Boston Beer’s Twisted Tea has so far lost ~8% points, consistently bleeding market share over this 14-month period,” Sarwat wrote.

In terms of channel distribution, Twisted Tea “skews dramatically to the convenience channel,” she added. In xAOC, which excludes convenience, Twisted Tea’s business appears to be seasonal, with “share increasing particularly in the summer season and falling back down in the colder months,” Sarwat wrote.

Twisted Tea’s xAOC volume was 32% in June 2023 and c-stores accounted for the remaining 68% of the brand’s volume, which “has remained broadly consistent over the last five years.”

“Given that the overall convenience channel is smaller than xAOC in the U.S., this shows there still remains large areas to grow for Twisted within the non-convenience channel,” Sarway wrote.

The brand’s total distribution points (TDP) and all commodities volume (ACV) “were solidly growing and velocity was stable” when Sarwat wrote her last Twisted Tea update in 2022.

“This implies that Twisted Tea ticked all the boxes of a healthily growing brand – the perfect storm of getting more products in more stores whilst maintaining consistent sales per distribution point off a growing base,” she wrote. “However, in 2024, growth in distribution breadth has moderated and velocity has started to decline, although distribution depth continues to grow strongly. Overall, this has resulted in a net deceleration in the last 12 months.”

Twisted Tea, which is 23 years old, has long had a strong foothold in its home market of New England, where New Hampshire, Maine and Vermont have the highest consumption per capita, Bernstein reported.

“The average legal drinking age consumer in New Hampshire, Vermont and Maine drinks more Twisted Tea than Modelo,” Sarwat wrote. “It is our understanding that Boston Beer initially expected the brand to do well in the South, where consumer appetite for sweet tea is high. Instead, it found a loyal consumer based in blue collar workers in the Northeast who were looking for a fun and indulgent alcoholic drink.”

Per capita consumption has declined slightly in Vermont and New Hampshire (both -0.1%) between August 2022 and June 2024, Bernstein reported. During this time, the strongest growth came from western markets: New Mexico (+1.1%), Arizona (+0.8%), Oregon (+0.7%), Washington (+0.6%) and Nevada (+0.6%).