Move over domestic premiums, imports are king.

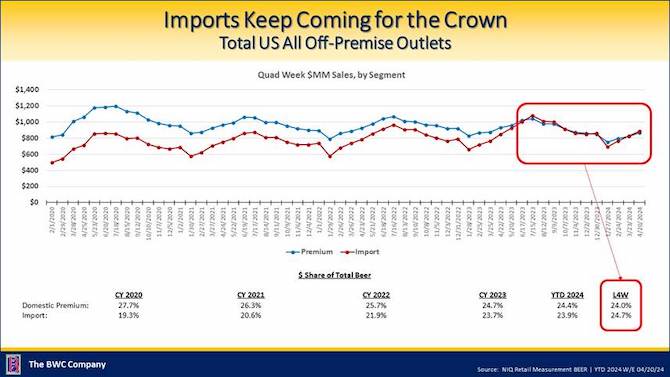

Imports overtook domestic premiums in dollar sales in NIQ-tracked off-premise channels in the four-week period ending April 20, making imports the No. 1 beer segment in scans, Bump Williams Consulting founder and CEO Bump Williams reported in the firm’s latest monthly report.

Imports increased share of total beer dollars sales by +5.1 points in the four-week period, to 24.7%. Meanwhile, premium lights’ share declined -7.2 points, to 24%.

“We saw flashes of this also take place throughout Q3 and into Q4 last year … as the gap between segments rapidly tightened,” Williams wrote. “But carrying over into the start of 2024 is yet another new phenomenon and it has to make you wonder at what point we’ll see imports claim that No. 1 rank on a running YTD [year-to-date] basis in addition to selective cuts of more recent time periods.”

From 2020 to 2023, the share gap between domestic premiums and imports shortened from 8.4 percentage points, to 1 point. YTD, domestic premiums have 24.4% share of beer category dollars, while imports have 23.9%. Trends are expected to continue, as domestic premiums have started to lap more favorable year-over-year (YoY) comps – past the year anniversary of the conservative-led boycott of top brand Bud Light (Anheuser-Busch InBev) – yet are still recording share loss.

The share exchange is not just from Bud Light declines – particularly as domestic brand performances are “slowly trending back toward historical levels” – but more from consumer shifts toward more flavor-forward bev-alc, Williams wrote.

The collective domestic pie, which includes the premium, super premium and below premium segments, increased dollar sales +3.8% in Q1 2023 versus Q1 2022, but every quarter since has reported year-over-year (YoY) declines: -1.6% in Q2, -1.9% in Q3, -5.6% in Q4 and -5.7% in Q1 2024. In the last four weeks, domestics dollar sales declined -4.4%, with declines from all three subsegments: domestic premium -7.2%, super premium -1.7%, below premium -0.6%.

Individual brand performances have varied. A-B continues to battle Bud Light declines, but Michelob Ultra and Busch Light are recording growth (+1.4% and +5.2%, respectively, in the last four weeks). And Molson Coors’ Miller Lite and Coors Light, along with Yuengling Lager – “beneficiaries of the initial Bud Light brand exodus” – continue to grow YoY on a quarterly basis, but are starting to slow and even entered the red in the last four weeks.

“While there were some BIG winners within the domestic landscape over the past year on an individual basis, there is clearly still an underlying bleed taking place as beer dollars continue shifting away from these domestic leaders and are instead being allocated elsewhere across beverage-alcohol (or non-alc alternatives),” Williams wrote.

“Perhaps this recent jump from Mich[elob] Ultra and Busch Light can be sustained and re-ignite some of those lagging domestic trends, but with so many of the premium leaders either still in decline or slipping into the red, the narrative of this evolving landscape toward imports and flavor will only continue to look more and more pronounced,” he continued.

Of the top 25 growth brands for the week ending April 20, 18 were imports or flavor-centric segments (i.e. flavored malt beverages or hard seltzers). Nine of the top 25 were imports, all of which were offerings from Constellation Brands: No. 1 Modelo Especial; No. 5 Pacifico; No. 6 Victoria; No. 12 Corona Familiar; No. 15 Modelo Chelada Limon Y Sal; No. 17 Modelo Especial Chelada; No. 18 Corona Extra; No. 21 Modelo Aguas Frescas assorted; and No. 23 Corona Non-Alcoholic.

The remainder of the list included:

- Six FMBs (Molson Coors’ Simply Spiked variety pack and Arizona Hard Tea assorted, Boston Beer’s Twisted Tea assorted and Twisted Tea Half and Half Tea, Mark Anthony Brands’ Cayman Jack Margarita assorted and A-B’s Canta Ritos variety pack);

- Four hard seltzers (Boston Beer’s Truly Bring The Party and Mark Anthony Brands’ White Claw Hard Seltzer Blackberry, White Claw assorted and White Claw Surge assorted);

- Four domestics (A-B’s Busch Light, Michelob Ultra and Natural Light, and Molson Coors’ Coors Banquet);

- And two craft brands (New Belgium’s Voodoo Ranger Juice Force and A-B’s Kona Big Wave Golden Ale).

Of the top 25 new beer brands in the latest week, all but one were “flavor-centric” or featured “tropical notes.” The one exception was Sierra Nevada’s Trail Pass IPA, a non-alcoholic beer, which “could also easily fall within this ‘new wave’ of brands and attributes that continue to gain focus and traction,” Williams wrote.

Thirteen of the top 25 were FMBs, five were hard seltzers, five were craft, one was cider and one was an import.

“While on one hand we may finally be approaching a bit of normalcy in select trends once we fully work through April and the months leading into summer that saw most of the volatility in 2023 … we are now left to balance that against the regression taking place in other areas,” Williams wrote.

“Premium brands are still the most valuable segment to have on the retail shelf in terms of a per item return,” he continued. “But imports and flavors continue to gobble up real estate at a rapid pace all while maintaining the collective growth to justify the increasing attention.”