Want to know how much craft beer was brewed in 2016? It’s not as straightforward as you might think, due to the varying definitions of craft and the investment activity in the space.

The Brewers Association, which represents the interests of small and independent American brewers, pegged craft brewery production growth at 6 percent, to 24.6 million barrels, in 2016.

But that’s just one reading. There are 5,301 beer companies that produced what many drinkers would consider to be a “craft beer,” but the BA only counted production from 5,234 of them.

Why? Because the BA’s at-times confusing definition of what it means to be a craft brewer, and ongoing acquisitions of small-batch producers by entities the BA would not consider to be “craft,” has made the job of parsing the data more difficult.

That definition discounts an estimated 1.2 million barrels of beer made by companies such as Ballast Point, which was acquired by Constellation Brands in 2015 for $1 billion, or Lagunitas, which sold a 50 percent stake to Heineken that same year, from its 2016 report.

If it could have counted those barrels, growth within the craft category would have been “a point or two higher,” according to BA chief economist Bart Watson.

“Small and independent brewers were able to fill in the barrels lost to acquisitions and show steady growth but at a rate more reflective of today’s industry dynamics,” Watson said in a press release. “The average brewer is getting smaller and growth is more diffuse within the craft category, with producers at the tail helping to drive growth for the overall segment.”

Despite losing barrels from dozens of acquired and now former “craft brewers,” the 5,234 companies the BA does still consider to be “craft brewers” and counts in its data set added 1.4 million new barrels of beer to the category last year. In fact, microbreweries and brewpubs delivered 90 percent of category-wide growth last year, the group said.

But there’s yet another wrinkle in the statistics: In a conversation with Brewbound, Watson said the BA counted a portion of non-BA defined craft brewer volumes in its 2016 report. The organization “pro-rated” production from breweries like Devils Backbone, which was purchased by A-B InBev last April, and Terrapin, which sold to MillerCoors last July, he said. The BA included some volumes from those companies in their topline tally until the acquisitions were finalized.

And if an official closing date wasn’t reported, the BA “estimates” production based on when it believes a deal was expected to close.

In other words — actual craft brewer production volumes may vary.

Production wasn’t the only craft category statistic the BA revealed today as part of its annual “Growth in the Beer Category” report, however.

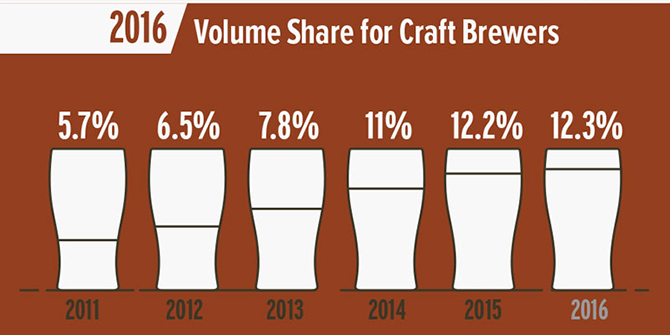

According to the BA, small and independent brewers accounted for 99 percent of all breweries in operation last year and 12.3 percent market share by volume. The makeup of the thousands of breweries looks like this: 3,132 microbreweries (companies producing up to 15,000 barrels annually), 1,916 brewpubs, 186 regional craft breweries (companies making between 15,000 barrels and 6 million barrels annually) and 67 large (companies making more than 6 million barrels annually) or otherwise non-craft brewers as defined by the Brewers Association.

Of the 5,301 U.S. breweries in operation in 2016, 826 new companies opened their doors, a 16.6 percent increase over the previous year, the BA said.

Brewery closures, a topic that has made numerous headlines already in 2017, were up from the previous two years: 78 breweries shuttered in 2015 and 75 closed in 2014. The group counted 98 closures (including MillerCoors’ Eden brewery) in 2016 although Watson said those figures are preliminary.

“I’d expect that number to rise a little bit,” he said.

Retail dollars for the year were up 10 percent, to an estimated total of $23.5 billion; BA-defined craft brewers claimed a 21.9 market share by dollars.

Craft breweries also accounted for 128,768 jobs last year — almost 7,000 more than the previous year.

Watson stressed during a call with reporters that the data varies in different parts of the country and in different channels, with many craft brewers showing “strong growth” in convenience stores.

“Some parts of country saw stronger growth than 6 percent that was in line with previous years,” Watson said.

For example, Texas and Florida are “still seeing strong growth” and there’s a “huge variation state by state.”

However, Watson did note that the days of 18 percent growth are likely over and he attributed that to the industry maturing.

“Having growth rates in an industry of this size is nearly impossible going forward,” he said.

Watson is expected to give a more detailed analysis of the numbers at this year’s Craft Brewers Conference & BrewExpo America from April 10 to 13 in Washington, D.C.