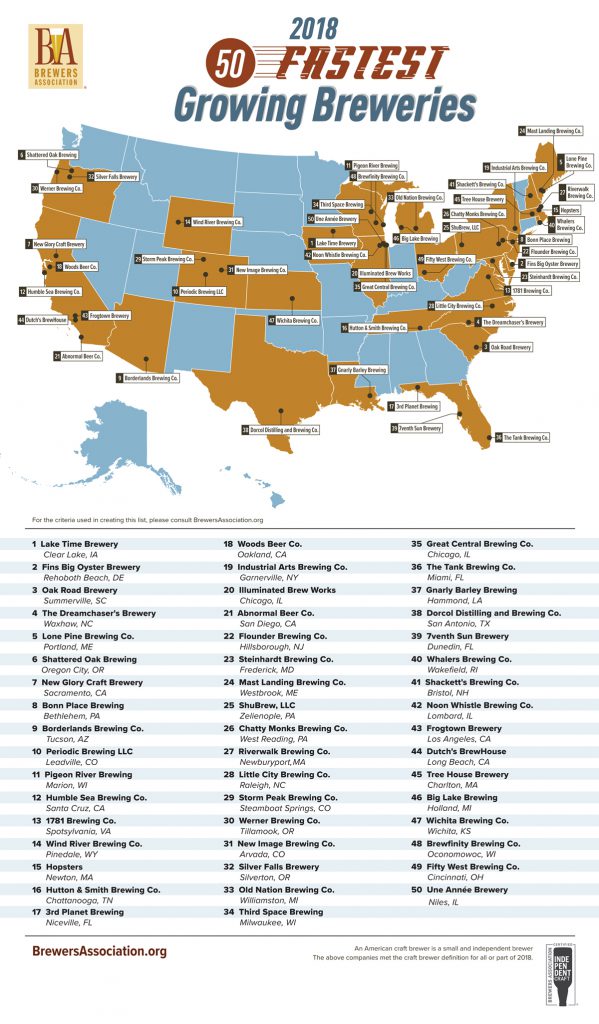

An Iowa craft brewery topped the Brewers Association’s (BA) list of the 50 fastest-growing breweries of 2018, but it wasn’t Toppling Goliath.

No, the distinction of being the fastest-growing U.S. brewery in 2018 belongs to Lake Time Brewery.

If you’ve never heard of Lake Time, you’re probably not alone. In fact, roughly 5,000 new breweries have opened since 2012, when Lake Time opened, and chances are you haven’t heard of many of those operations or the companies on this year’s fastest-growing breweries list.

The 7-year-old Lake Time — located in Clear Lake, Iowa, a vacation haunt for Midwesterners about 30 minutes from the Minnesota border — produced 1,300 barrels of beer in 2018, according to co-founder Bob Rolling. That’s up from an estimated 220 barrels in 2017, which Rolling attributed to opening a new production facility and installing a canning line.

This is the second year that the BA has released the list of fastest-growing breweries. Last year’s top honor went to Milford, Massachusetts-based Craftroots Brewing, which produced 308 barrels of beer in 2017, up from 20 barrels the year prior. Craftroots didn’t make a repeat appearance on this year’s list, however.

According to the BA, the small and independent breweries on the 2018 list ranged in size from 50 barrels of beer to more than 40,000 barrels. The list consists of two regional craft breweries (companies making more than 15,000 barrels of beer), 35 microbreweries (companies making fewer than 15,000 barrels of beer) and 13 brewpubs. Those companies accounted for 10 percent of the total craft volume growth, increasing from fewer than 70,000 barrels collectively in 2017 to more than 170,000 barrels in 2018. The BA has not yet released 2018 production numbers for individual breweries.

“Even as market competition continues to increase, these small and independent breweries and brewpubs demonstrate there are still growth opportunities across a diverse set of regions and business models,” BA chief economist Bart Watson said in a press release.

The median size of breweries on the 2018 list was 1,350 barrels, up from 963 barrels in 2017, while the median growth was 163 percent, according to the BA.

In order to be considered on the 2018 list, breweries were required to submit in-house production data to the BA for its “Beer Industry Production Survey.” Those companies also had to have opened by December 31, 2016.

Although official production figures were not disclosed, it is believed that the largest brewery on the 2018 list was popular hazy IPA maker Tree House Brewery. The Massachusetts-based craft brewery produced 19,250 barrels of beer in 2017, and likely sold more than 40,000 barrels last year. Tree House did not immediately respond to an inquiry regarding 2018 production figures.

On the other end of the spectrum, a handful of companies on the list produced fewer than 100 barrels in 2017, including Long Beach, California-based Dutch’s BrewHouse, which made just five barrels of beer that year.

Oakland, California’s Woods Beer Co., ranked No. 18 on the 2018 list, doubled its production to 1,000 barrels last year, founder Jim Woods told Brewbound. Ninety-five percent of that beer was sold directly to consumers across the company’s five pubs. The other five percent was sold through distribution channels.

“I’m hoping to double this year and that will be driven by probably some wholesale distribution,” Woods said, adding that he’s hoping to add 100 new points-of-distribution, mostly on-premise accounts, throughout the Bay Area.

“That’s how you build a brand,” he said.

Woods added that his company would potentially open a few more pubs, as well.

“We’ve always got some iron in the fire,” he said. “We’re being really selective right now because we think there’s going to be some good opportunities open up.”

On the opposite coast, Riverwalk Brewing Company, which ranked No. 27, produced about 3,300 barrels of beer in 2018. The Newburyport, Massachusetts-based craft brewery’s production had declined from 1,095 barrels in 2016 to 765 barrels in 2017.

Riverwalk Brewing founder and brewer Steve Sanderson explained that the 7-year-old company ceased production for about three months in 2017 as it moved into a 20,000 sq. ft., $1.5 million production facility with a taproom — something it didn’t have before.

“We built this place to scale into as well, so there’s room to grow beyond that,” he added.

Riverwalk has been able to accelerate production and sales with its new 30-barrel brewing system and canning line. The company’s taproom, meanwhile, has also been a boon as over-the-bar sales now account for about 20 percent of Riverwalk’s sales.

“2018 was when all of those things came together for us,” Sanderson said.

In 2019, Riverwalk is forecasting additional growth, targeting as much as 6,000 barrels of production, Sanderson added. Some of that growth will come from additional retail placements in about 30 Hannaford grocery stores in New Hampshire and Maine.

Meanwhile, Miami’s The Tank Brewing Co. produced nearly 3,500 barrels of beer in 2018, up from a reported 520 barrels in 2017, according to owner Carlos Padrón.

Moh Saade, head brewer at The Tank, told Brewbound that the brewery had recently “quadrupled production,” and is now brewing about 360 barrels of beer a month.

“I’m working to squeeze every little ounce of beer out of this place,” he said.

Over the last nine months, The Tank has added can packaging for its flagship Freedom Tower amber ale, and La Playita pilsner, while simultaneously widening its distribution footprint in Florida, Padrón said.

“That’s where the growth is coming from,” he said.

Freedom Tower accounts for 60 percent of The Tank’s production, Saade added, noting that the company was able to own a local market that was largely devoid of the style.

“It’s a big pond with no fish in it,” he said.

Looking ahead to 2019, The Tank is banking on an even bigger year as it opens additional off-premise accounts. Currently, only 10 percent of The Tank’s beer is sold in package, Padrón said, but the company expects that number to rise as it received authorizations for Whole Food stores this month. It also hopes to secure additional chain grocery placements in the coming months.

Finally, fast-growing Cincinnati craft brewery Fifty West Brewing Co. found its way onto the list at No. 49 after increasing production from just under 4,000 barrels in 2017 to 6,500 barrels in 2018. Co-founder Bobby Slattery told Brewbound that the company is forecasting about 9,000 barrels in 2019.

“Just like in years past we focus on building a brand first and foremost and not necessarily a target production barrelage,” he added. “Obviously that led to some significant growth this past year.”