Karben4 Brewing has filed Chapter 11 bankruptcy, citing the continued impact of the COVID-19 pandemic, and internal disputes among ownership.

The Madison, Wisconsin-based brewery filed for bankruptcy in the U.S. Bankruptcy Court for the Western District of Wisconsin on February 26. The company plans to continue to operate, and has already received court approval for its initial requests in the filing, including coverage for employee salaries, and the ability to honor gift cards, The Cap Times reported.

The company confirmed the news Friday on social media, writing: “It is true that Karben4 has filed for Chapter 11 bankruptcy protection. It is also true that we will continue to operate and conduct business largely as we have for the past 11 years, producing and pouring the finest beer on Madison’s East Side. We aren’t going anywhere! All of our Karben4 beers and all of our contracted beverages will continue to be made by the K4 team with great love. Business as usual.

“We are eternally grateful for the support you have shown our business over the past decade plus, and we ask that you continue to provide us with an unbreakable foundation as we navigate through this restructuring. We plan to emerge on the other side stronger than ever.”

The news comes nearly a year after Karben4 announced it had acquired the intellectual property of Ale Asylum, the Wisconsin brewery that permanently closed in July 2022 after 16 years.

At the end of last year, Alex Evans sued fellow Karben4 co-owners Ryan and Zak Koga over the deal, as well as a separate similar deal for Wisco Pop craft soda in January 2022, claiming the Kogas – who are brothers – “misappropriated corporate opportunities from Karben4.”

The lawsuit, filed in Dane County Circuit Court, alleges that the Kogas placed ownership of the IPs of Ale Asylum and Wisco Pop in separate companies from Karben4, then signed Karben4 on as the contract producer of the companies’ products, ensuring that “the entities owned by Ryan and Zak, not Karben4, receive the full benefits from the sale of the Ale Asylum and Wisco Pop products.”

Documents from the bankruptcy filing, including a declaration from Zak Koga, shed more light on the disputes between co-owners – which stemmed years before the Ale Asylum and Wisco Pop deals – as well Karben4’s financial situation.

The Financial Woes

Founded in 2013, Karben4 grew its gross revenue to $4 million by 2019. However, the company “operated at a loss,” with net operating income of -$86,613 in the year before the pandemic, according to a declaration Koga filed with the court.

The company attempted to cover losses by licensing and selling the territorial rights of its brands to wholesalers, totaling $2.6 million between 2013 and 2020.

“Unfortunately, the company has no more territory in Wisconsin to license/sell and wholesalers are no longer interested in buying brands,” Koga wrote. “That revenue source is no longer available.”

Karben4 turned to contract brewing for other beverage companies to help support the loss of on-premise sales during COVID-19. Gross contract sales totaled $34,843 in 2020, Koga wrote. The company “broke even on an operating basis in 2020, posting a net operating loss of -$6,620.”

Additionally, the company received $245,000 from the Small Business Administration (SBA) through the Paycheck Protection Program (PPP). That loan was forgiven with interest in 2021.

“The pandemic had a lasting effect on the craft beer industry,” Koga wrote. “High profit margin kegs did not rebound to pre-pandemic levels. Employees became difficult to obtain and wages increased as the job market tightened.”

In 2021, Karben4’s retail gross sales income declined -$500,000 and wholesale gross sales declined -$600,000. The company recorded a net operating loss of -$207,727, offset by earned income credit and the forgiveness of the PPP loan.

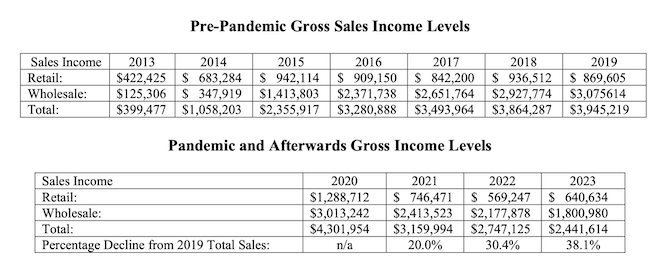

By 2022, the company’s payroll had also increased +15% versus 2019, to $1,345,946, and total gross income had declined -14% versus 2019. The company “has yet to achieve pre-pandemic sales levels for comparable products” after an initial boost in early 2020 from to-go sales, Koga said, as delineated in the below chart:

The bankruptcy filing lists Karben4’s 20 largest unsecured claims, including a partially unsecured claim from the SBA based on a $2 million economic injury disaster loan (EIDL), $1 million of which is unsecured. Other unsecured claims include, but are not limited to:

- $33,612 to the Brewers Supply Group (BSG);

- $14,125 to Yakima Chief Hops.

- $13,000 to Kinsman Investors;

- $12,115 to Community First Credit Union (CFCU);

- $10,000 to Craft Beverage Warehouse;

- $7,901 to Gamer Packaging;

- $5,000 to Malteurop Malting Company;

- $3,501 to Country Malt;

- $3,104 to General Beer Distributors;

- $3,000 to Menasha Packaging Company;

- $3,000 to Valley Cooperative Association;

- $1,000 to the Internal Revenue Service (IRS) Insolvency Operations;

- And $1,000 to the Wisconsin Department of Revenue.

Karben4 has been granted liens in “account receivable, inventory and all its other assets” to two creditors: the SBA and the CFCU. Monthly payments of interest and principal for the SBA loan total $9,869. The principal balance for the line of credit given to Karben4 by the CFCU was $80,000, with monthly interest payments now at $600. The loan was due on March 1, but Koga is currently in discussion with CFCU to get an extension, according to the filing.

2023 marked the first time Karben4 owed on its line of credit, and marked “an annual low” for the company’s bank account balance, according to Koga. Total liabilities for the company increased from $685,260 in 2019, to $2,425,948 in 2023, “resulting in annual interest costs that for 2023 totaled $150,606,” Koga wrote.

“If the company did not file Chapter 11, it would need to further draw on its line of credit,” Koga wrote. “Eventually, it would run out of cash.”

Ownership Disputes

Disputes among Karben4 ownership started at the creation of the company, according to Koga’s declaration.

When Karben4 was founded, ownership was split between Evans (20%) and his father Stephen Evans (30%) – referred to in Koga’s declaration as “Mr. Evans” – Ryan and Zak (shared 20%) and their father John Koga (10%). Zak alleged that Mr. Evans – who provided a $170,000 loan to help start the company – promised that when the loan was paid off, ownership would change to 25% each for Evans and the Koga brothers, and 12.5% for each father.

“We had hoped that Mr. Evans would honor his commitment when the loan was paid in full,” Koga wrote. “However, that did not happen.”

By the summer of 2018, “tension came to a head” between Zak Koga and Alex Evans, when Evans allegedly “blew up” at Koga during a charity function, “yelling at [Koga] in front of everyone,” Koga wrote.

“Afterwards, Alex sent text messages to me saying he hated me, and Alex would make a move to buy Ryan and I out,” Koga wrote.

“Days later, without first informing Ryan or me, Alex approached a key employee with a nondisclosure agreement to determine if she would stay if Ryan and I were gone,” Koga continued. “When Ryan and I learned of Alex’s action, we viewed Alex as manipulative and deceitful.

“Things did not get resolved and by the end of 2018, Alex was coming into the office two days a week; that dropped to one day a week in early 2019. By April 2019, Alex did not come into the office at all. He continued receiving the same salary as Ryan and me.”

On December 31, 2019, Mr. Evans allegedly “gifted his 30% interest to Alex,” growing his interest in the company to 50%. At the same time, Evans and the Kogas were allegedly trying to work out a deal to buy Evans out, according to Zak Koga’s declaration. However, on March 23, 2020, all involved parties entered an agreement to pause negotiations due to the COVID-19 pandemic, with the intent to start up again before June 1, 2022, according to Koga.

“Alex resigned as a manager, leaving Ryan and I as the sole managers,” Koga wrote. “However, he continued to receive a salary even though he provided no services to the company.”

Evans and the Kogas have allegedly not received salaries since November 2023 due to “continuing losses” at the company.

Problems rose again in April 2023, allegedly after Evans was notified of the purchases of the Wisco Pop’s IP, and the nearly-closed purchases of Ale Asylum’s IP. Evans obtained counsel which led to the aforementioned ongoing November lawsuit

On February 2, Evans’ counsel also filed a demand for arbitration against Ryan and Zak Koga with the American Arbitration Association.

“Efforts to resolve differences have gone nowhere,” Koga wrote. “Offers to have a valuation specialist value the company so an amount could be determine (sic) Alex’s interest was rebuffed. His last demand for his 50% interest was $2.5 million. Alex also refused to talk with an investor interested in buying him out.

“Alex has an unlimited war chest for litigation from his wealthy father, who appears to be funding the litigation since Alex has not worked since leaving the company in 2018,” Koga continued. “From our viewpoint, Alex and his father want to put the company out of business.”

Koga added that “an unrelated third-party is willing to invest in the company,” but “not under the present distressed situation.”

“The present plan to exit chapter 11 is for the company to continue operating and receive an investment from the third-party,” Koga wrote. “The combination of the investment and continued operations will permit the maximum payments to creditors.”

Karben4 has not responded to Brewbound’s request for comment as of press time.

Several other craft breweries have filed for Chapter 11 bankruptcies in recent months, including Minnesota’s Fair State Brewing, New Jersey’s Flying Fish and Georgia’s Pontoon Brewing. Massachusetts-based Craft Beer Cellar filed for Chapter 7 bankruptcy in February.