Nearly 60% of Drizly users ages 21-26 plan to drink hard seltzer this summer, the on-demand e-commerce marketplace and delivery platform for alcohol beverages, found during its second annual consumer survey.

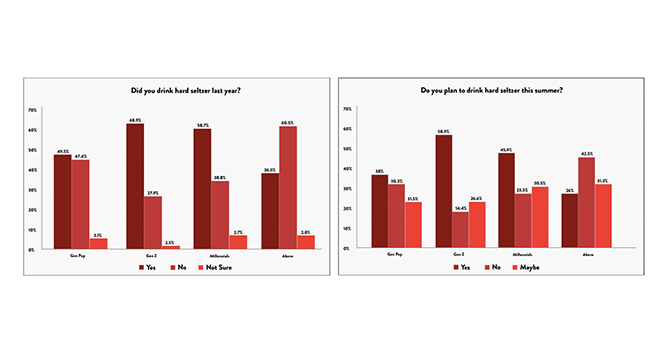

Although the number of hard seltzer consumers in that age group — 58.9% — is high, it’s 10% lower than the percentage of 21- to 26-year-olds who drank hard seltzer last summer, indicating that consumers who were curious about the segment last summer satisfied their curiosity and decided that hard seltzer wasn’t for them, according to Drizly.

This pattern also plays out across the other two age groups in the study. In the Millennial group, 58.7% drank hard seltzer last summer, but only 45.9% plan to drink it this summer. For Gen X and older, fewer tried it last summer (36.5%) and fewer plan to this summer (26%).

Overall, 49.5% of respondents drank hard seltzer last year, and just 38% plan to this summer. Nearly a third said they might drink hard seltzer this summer.

“We were also surprised that, according to the self-reported data, consumers seemed less committed to the category given the ‘affirmative’ group declined from 49% to 38%,” Drizly director of consumer insights Liz Paquette told Brewbound. “Still, the combined affirmative/maybe group increased significantly from 53% to 69%. We do expect total category volume to continue to grow rapidly, and we are seeing this trend currently on Drizly.”

Still, those who continue to drink hard seltzer are drinking a lot of it. For the 52 weeks that ended June 13, consumers spent $2.69 billion on hard seltzer at off-premise retailers, according to market research firm Nielsen. Hard seltzer’s growth trends have decelerated slightly, going from a 300.7% increase in dollar sales for the 13 weeks ending June 13, to a 251.7% increase in dollar sales for the four weeks ending June 13.

On Drizly, an online marketplace that connects drinkers to retailers who offer home delivery, hard seltzer’s increase is even greater.

“From May to June of 2020, hard seltzer sales were up nearly 1,200% year over year,” Paquette wrote. “Over the last few months, sales of [this] category have experienced outpaced growth compared to Drizly overall and most other categories on the platform.”

Hard seltzer, which is primarily sold in off-premise retailers, had a leg up over other alcohol beverages when the COVID-19 pandemic shuttered on-premise establishments nationwide and forced Americans to stay home.

“Certainly sales overall have accelerated and that has had an impact on this category specifically,” Paquette said. “Success of hard seltzer started in [the] off-premise [channel.] Though sales were starting to take off in on-prem as well, it’s no doubt that the last few months have only benefited this category.”

Drizly also found that as people stayed home, they experimented more with mixology. More than half — 52.1% — said they have tried making cocktails at home in the past three months and 54.8% expect to continue the practice in the future. From March 23 to May 25, Drizly orders of liqueurs, cordials and schnapps increased 814% and orders of mixers, syrups and bitters increased 1107% over the platform’s baseline.

Once on-premise establishments begin to reopen — which is increasingly more in doubt as states and counties close bars and restaurants and postpone reopening phases as the coronavirus continues to spread — only 17.3% of respondents said they would drink less at home. Almost 30% say they would drink more at home. More than half — 53.1% — weren’t sure.

New Hard Seltzers Brands for Summer 2020

In a segment that’s been dominated by two lead brands — Mark Anthony Brand’s White Claw and Boston Beer’s Truly Hard Seltzer), that 46.3% of Drizly found that 46.3% of respondents said they “will probably try some different brands.”

Last year, 78.3% of respondents drank White Claw, while 52.7% of respondents drank Truly. The other four brands that respondents also drank were Anheuser-Busch InBev’s Bon V!V Spiked Seltzer (13.6%), Gallo Winery’s High Noon Hard Seltzer (7%), A-B’s Natural Light Hard Seltzer (3.8%) and Mass. Bay Brewing’s Arctic Summer (3%).

The landscape has changed for Summer 2020 with entrants from global brewers (A-B’s Bud Light Seltzer, Constellation Brands’ Corona Hard Seltzer and Molson Coors’ Vizzy) as well as craft breweries, and drinkers’ plans have changed accordingly.

Bud Light Seltzer and Corona Hard Seltzer still have a wide gap between them and the segment leaders.

Since its January launch, Bud Light Seltzer’s variety pack has entered the global beer manufacturer’s top 10 brands in multi-outlet and convenience stores, according to IRI. The variety pack and Bud Light Seltzer’s four single-flavor offerings have sold $129.6 million in IRI tracked stores year-to-date.

According to Drizly, consumers will spread their dollars on eight hard seltzer choices this summer, while 23.5% of consumers are unsure and 7.1% said they won’t buy them at all:

- White Claw — 52.2%,

- Truly — 34%,

- Other craft seltzer — 14.8%,

- Corona Hard Seltzer — 13.3%,

- Bud Light Seltzer — 12.7%,

- High Noon — 9.8%,

- Bon V!V — 9.5%,

- Arctic Summer — 3.5%,

- Natural Light Hard Seltzer — 3.4%.

The number of hard seltzer brands available on Drizly has almost doubled since 2019, Paquette added.

“Over the last few months in particular, we’ve seen a spike in market share for independent companies in beer,” she wrote. “We would anticipate the shift to independent, craft companies to translate over into the hard seltzer category as more brands enter the market.”

Craft brewers with recent hard seltzer lines include No-Li Brewhouse’s Day Fade, COOP Ale Works’ Will & Wiley, Sycamore Brewing’s Bubs, and Destihl’s Craft Hard Seltzer. Earlier hard seltzer entrants from craft breweries include Arctic Summer, Deep Ellum’s Blind Lemon, Oskar Blues’ Wild Basin, Wachusett Brewing’s Nauti, Night Shift’s Hoot and Braxton’s Vive.

Paquette noted that Drizly users over-index in the craft segment and that some of the dollars they were previously spending on craft beer have gone toward hard seltzer. She expects hard seltzer offerings from craft breweries to have the potential to sell well on the platform.

“There are early signs of this, with craft seltzers jumping from 1.22% of share in 2019, up to 3.82% in Q2 of 2020,” she wrote. “Additionally, we know that consumers are open to trial – in our 2020 consumer survey, 46.3% of survey respondents stated that they ‘will probably try some different brands’ this summer and another 14.9% anticipated ‘trying a bunch of brands to see what I like.’”