IPA drinkers in Connecticut and Delaware have boosted the style to have the largest share of craft off-premise dollars in the country, according to a recent report from Brewers Association (BA) staff economist Matt Gacioch.

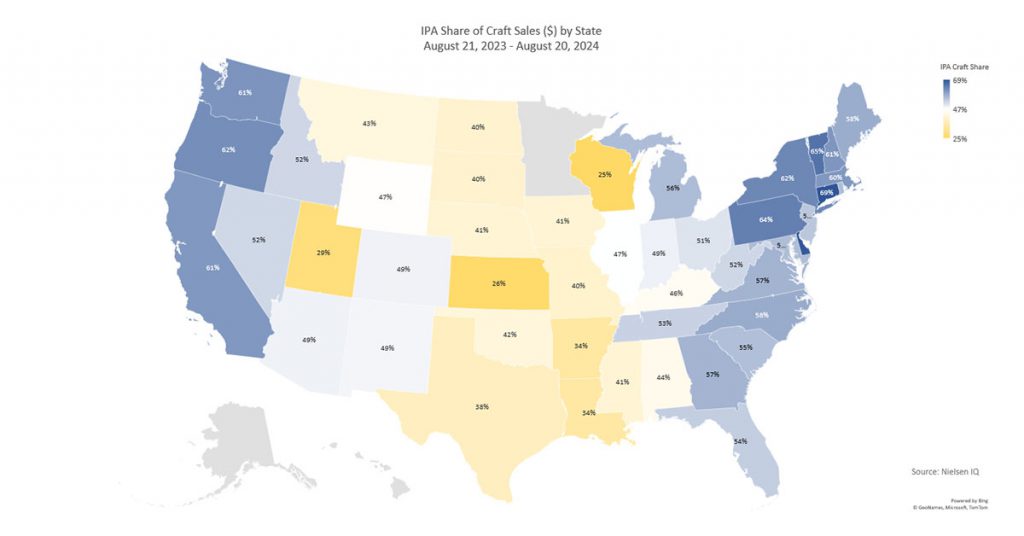

The geographically tiny East Coast states both boast a 69% share of craft dollars spent on IPA in the 52-week period ending August 20, according to NIQ data cited by Gacioch.

This is a higher dollar share for the style than in the home states of some of the best-selling IPAs nationwide.

In Colorado – home to New Belgium, whose Voodoo Ranger Imperial IPA and Juice Force Hazy Imperial IPA are the No. 2 and No. 3 best-selling craft beers, according to market research firm Circana – IPA accounts for 49% of craft dollars.

In California, home to No. 4 Sierra Nevada Hazy Little Thing, IPA has 61% share of craft dollars, as does Washington state, home of Anheuser-Busch InBev-owned (A-B) Elysian Space Dust IPA, the No. 4 craft IPA and No. 10 craft brand overall.

Brands from Kirin-owned New Belgium and A-B are excluded from the BA’s definition of craft beer, but included in data from NIQ and other market research firms.

Other states where IPA had a notably high dollar share include Vermont (65%), Pennsylvania (64%), New York (62%), Oregon (62%), New Hampshire (61%) and Massachusetts (60%).

States where IPA’s share of craft dollars was below 40% include Wisconsin, which was the lowest at 25%, Kansas (26%), Utah (29%), Arkansas (34%), Louisiana (34%) and Texas (38%).

Data was not available for Minnesota, Alaska and Hawaii.

In each of the four mega geographic regions, IPA’s dollar share has grown since 2020. The style has a majority of craft dollars in every region except the Midwest (Ohio, Michigan, Indiana, Illinois, Wisconsin, Minnesota, Iowa, Missouri, Kansas, Nebraska, South Dakota and North Dakota), where it accounts for 45% of dollars.

On a regional basis, IPA has its largest dollar share in the Northeast (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut, New York, New Jersey and Pennsylvania) at 62%.

“At least from a regional perspective, brewers across the country need to care about IPA,” Gacioch wrote. “Within the 15 style groups provided by NIQ, the top three groups by region make up between 71-81% of total craft sales in those regions. So, it can be a risk for brewers to pursue just the long tail of styles.”

Where IPA is less dominant, other styles have been able to claim share. In 19 states where “outlier” styles popped more than in other states, 12 “are driven primarily by one brand that accounts for over 50% of sales of that style in that state,” Gacioch wrote.

Examples of this “iconic ‘state styles’” phenomenon include Gambrinus-owned Shiner Bock in Texas, New Glarus Spotted Cow in Wisconsin and Abita Amber Lager in Louisiana. More than 75% of dollar sales of bock, saison and amber lager in Texas, Wisconsin and Louisiana, respectively, are going to one brand.

Some states have prominent styles with dollar sales spread across several brands. In Ohio, fruit beer claims a significant share, but the largest brand in the style accounts for 26% share, Gacioch wrote. Similarly, craft pilsners pop in Utah, but the largest brand only holds a 38% share.

“The discussion should not be about whether craft beer is the same everywhere across the country, but should instead be focused on the brands that are able to connect with consumers in specific states and regions,” Gacioch wrote.