Draft beer considerably outperforms package in on-premise outlets that offer both options, according to a report released today by Draftline Technologies and CGA, the on-premise arm of market research firm NIQ.

According to the report, draft commands 52.3% of U.S. beer volumes out-of-home compared to package (47.7%) “and delivers a significantly higher average value velocity.”

Zeroing in on California, one of the best draft markets in the world, draft outsells package by 367% in sales velocity when both formats are stocked in bars and restaurants, the report said, citing CGA BeverageTrak data for the 12-week period ending August 3.

By segment, those trends hold, including:

- Craft draft outselling package 657% in sales velocity;

- Domestic premium draft outselling package by 747%;

- Domestic super premium draft outselling package by 620%.

Pointing to those trends and echoing the report’s thesis, Draftline founder Jennifer Hauke told Brewbound: “Sometimes the consumer whispers; sometimes the consumer screams.

“Where draft is available, it is the drink of choice when it comes to the beer category,” she added.

Draftline and CGA broke down trends within the $21.8 billion draft beer business in the report, shared first with Brewbound. CGA and Draftline found that draft beer makes up 25% of all beer sales in the U.S. and accounts for 51% of off-premise beer revenue. There are also an estimated 1.5 million draft lines in the U.S., with the No. 1 handle nationwide being “open,” meaning no one brand holds the top spot nationwide.

Here are additional takeaways from the report:

Draft Trends Soft but ‘Resilient’

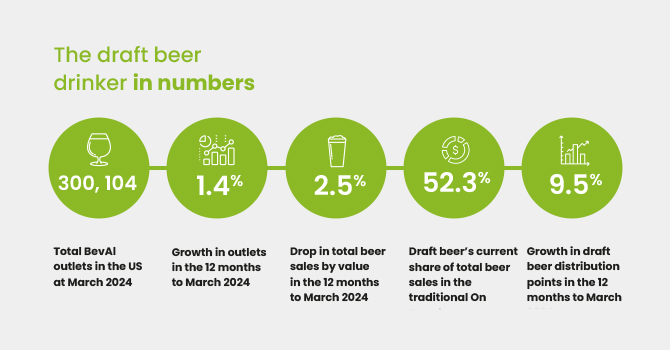

Draft sales declined -2.5% through the 12-month period through March 2024, the report found. Volume also declined -6.1% and rate of sale slipped -9.2% in the same period. Those softer trends were only partially offset by price increases.

“These negative trends are part of a wider fall in bev-al consumption in the U.S. on-premise,” the report said.

“Beer has proved more resilient than other mega-categories like spirits, where the drop in sales by value has been nearly three times as steep as beer at 8%; and wine, where it has been more than double at 5.5%.”

In the last year, draft and package sales in the on-premise both declined by value, -2% and -2.6%, respectively, over the 12-month period ending March 2024.

Nevertheless, CGA’s BeverageTrak data showed that draft commands a higher average value velocity in all sub-categories, particularly craft and super premiums. Draft also dominates mid-afternoon and early-evening dayparts, with velocity double that of packaged beers.

Draft has also increased its points of distribution by +8.1% over the last 12-month period, while packaged products have increased distribution +3.5%.

Craft Most Popular Draft Product in US

The report highlights the importance of draft to craft breweries. Craft accounted for 47.2 cents of every dollar spent on draft in the last 12-month period through March.

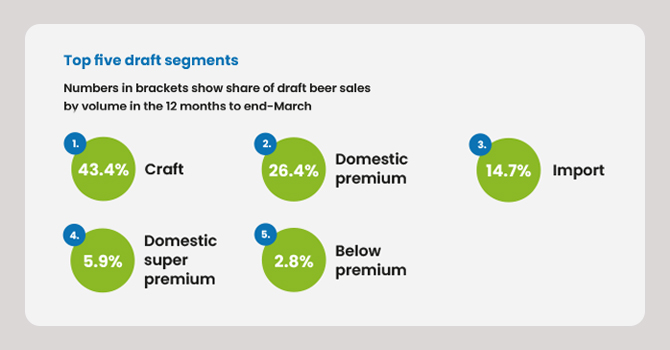

Craft also holds the largest share of draft beer sales by volume at 43.4%. The next closest segment is domestic premium (26.4%), followed by import (14.7%), domestic super premium (5.9%) and below premium (2.8%).

Within imports, Mexico and Ireland are the top countries for imported draft beer, with Mexico holding eight times the sales by value of Ireland.

Craft & Draft Outperform in California

The report offered a case study of draft beer trends in California.

Through mid-2024, total beer sales in California topped $4.4 billion, with draft making up 60.3% of those sales, beating the U.S. average of 52.3%. Draft also accounted for 80.5% share of total craft beer sales in California’s on-premise channel.

California consumers pay an average of $7.35 for a 16 oz. pour of draft beer, 12% higher than the average price of packaged beers $6.54, per the report.

Who is Buying Draft Beer?

CGA pinned down the key demographics of the 30 million people who have bought a craft draft beer over the last quarter. According to the report, 66% of craft beer consumers identify as male and 51% are aged 55 or over.

The report points out that draft consumers are valuable as they spend an average of $160 monthly on drinking and dining. That’s $11 more than the average consumer. They also have an average of 6.7 brands in their repertoire, a slight bump up from packaged beer consumers (6.5 brands in their repertoire).

Draft beer drinkers at a 63% clip dine out at least weekly, outpacing the average U.S. consumer, the report found.

As for the key 21- and 34-year-old demographic, they over-index in imports and are more likely than the average consumer to consider health aspects such as alcohol content and artificial ingredients. They also go out to eat more frequently than their older counterparts, with 71% of 21- to 34-year-olds dining out at least weekly, compared to 50% of consumers aged 55 and up.

The top five reasons consumers choose draft over packaged product are:

- 40% prefer the taste;

- 31% believe it is fresher;

- 28% prefer to drink from a glass;

- 23% draft served in their favorite venue is good quality;

- 23% say it’s cheaper.

Number of Selling Outlets Increases

The number of licensed on-premise outlets across the U.S. increased +1.4% year-over-year (YoY), to 300,104, as of March 2024, according to TD Linx data cited in the report. More than half of those outlets – around 180,000 – specifically sell draft beer.

The report calls out an increase in popular beer selling outlets, such as neighborhood bars (+1.7%), casual dining restaurants (+2%), sports bars (+0.4%) and quick-serve restaurants (+5.8%).

No/Low Alc Beers, Altbier, Blonde/Golden Ale Growing Styles

Within style trends, combined draft and packaged volumes of no- and low-alcohol beer have grown +25.9% YoY with distribution increasing +10.7%. The report states that there is an opportunity for continued growth in the years ahead as consumers moderate alcohol intake and take health into greater consideration.

Other styles posting volume growth in the on-premise for the 12-month period through the end of March include:

- Altbier +7%

- Blonde/golden ale +5.3%

- Stout +1.9%

- Amber lager +1.2%

On the flip side, pale lager and IPA draft volumes declined -6% and -5.8%, respectively. Seasonals declined -14.3%, pale ales -5.6% and pilsners -9.6%.

Hauke along with Lester Jones, National Beer Wholesalers Association VP of analytics and chief economist, will share additional on-premise and draft-focused insights during a presentation at the Brewbound Live business conference on December 11.