Anheuser-Busch InBev’s (A-B) U.S. shipments (sales to wholesalers) and depletions (sales to retailers) remained in the red in Q2 2024 as the company cycled the double-digit declines from this time last year, when the conservative-led boycott of Bud Light began following a promotion with Dylan Mulvaney, a social media influencer who is transgender..

A-B’s U.S. shipments and depletions declined single digits, -2.7% and -4.1%, respectively, in the second quarter, the first comps with boycott. U.S. revenue declined -0.6%, even as revenue per hectoliter increased +2.2%.

Recall that in Q2 2023, A-B’s U.S.shipments and depletions declined -15% and -14%, respectively, and revenue declined -10.5% as the boycott ramped up.

The single-digit declines marked an improvement compared to the double-digit declines in Q1 2024 trends as shipments fell -10.1% and depletions decreased -13.7%.

Through the first two quarters of 2024, A-B’s U.S. revenue dropped -5%, with revenue per hectoliter growing +1.6%. U.S. shipments declined -6.5% and depletions declined -8.6%. EBITDA is down -2.3%.

Asked about the progress of the Bud Light brand during a Q&A period, A-B InBev CEO Michel Doukeris said the company is seeing “stabilization” and “all brand indicators [are] getting better.”

“The brand is regaining consideration,” he continued. “The brand continues to have very high penetration, the brand has the largest distribution and we continue to invest in the properties and activations that all consumers love.”

Investment behind Bud Light will ramp up in the second half of the year as the NFL season kicks off, Doukeris added.

Doukeris stressed A-B’s work to “rebalance” its portfolio, with “above core beer and beyond beer brands generating approximately 45%” of its total revenue in the second quarter, calling out Michelob Ultra, Kona, Estrella, Nütrl and Cutwater. The latter two brands have helped A-B claim around 1.5% of share of spirits dollars in the U.S. and represent 25% of the total growth for this period in the off-trade in Circana data,” Doukeris said, citing data from the market research firm.

A-B reported “flattish” beer market share in the second quarter, citing improved trends for Michelob Ultra and Busch Light, “which were two of the top three volume share gainers” in the U.S. beer industry.

Doukeris said Michelob Ultra reached an “all-time high market share,” accelerating due to the Copa America soccer tournament and now with Team USA in the Olympics.

He also cited Busch Light being a top-three brand in the U.S. in terms of growth. A-B’s portfolio holds a 65% share of the value segment, with Busch being the largest brand. Doukeris added that Busch is “multiple times bigger than the largest competitor in the segment and is growing and performing very well,” he added.

The company reported that it gained volume share of the U.S. beer industry in May and June. Doukeris said there were further improvements in the early weeks of July with the July 4 holiday and improved weather, which weren’t recorded in the Q2 report.

“When you think about the overall portfolio, we are gaining share in the month of May in June, which is good signal stabilization,” Doukeris said.

Doukeris said the U.S. beer industry “remains very resilient” and pointed to beer performing well in comparison to spirits and wine, despite weather impacts in the quarter.

A-B’s Total Volume -0.8% in Q2

In Thursday’s earnings release, Doukeris called out the continuation of A-B’s “global momentum” in Q2.

“The strength of our diversified footprint and consumer demand for our megabrands delivered another quarter of broad-based top- and bottom-line growth,” he said. “EBITDA grew by double-digits and the continued optimization of our business drove a 25% increase in underlying EPS. We are encouraged with our performance in the first half of the year and remain focused on consistent execution of our strategy.”

A-B total volume decreased -0.8% in the second quarter, the company reported. The world’s largest beer manufacturer’s own beer volumes declined -1.3%, while non-beer volumes increased +3.4% in the quarter.

Halfway through 2024, the company’s total volumes are down -0.7%, with its own beer volumes declining -1.3% and non-beer volumes growing +3.5%.

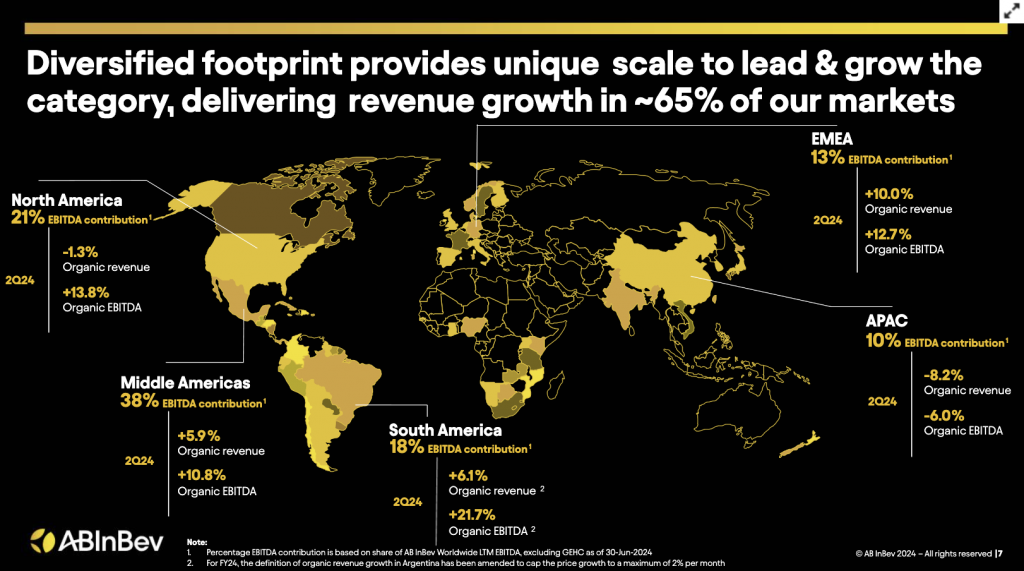

Nevertheless, A-B’s total revenue increased +2.7% in the second quarter, as revenue per hectoliter rose +3.6%. A-B noted that around 65% of its markets generated revenue growth.

Halfway through 2024, A-B’s total revenue is also up +2.7%, with revenue per hectoliter up +3.5%.

A-B’s Q2 earnings before interest, taxes, depreciation, and amortization increased +1.2%, to $5.3 billion, with normalized EBITDA margin expansion of 236 basis points, to 34.6%. That figure is up +7.8%, to $10.288 billion through the halfway point of 2024. Underlying profit stood at $1.811 billion in the quarter, up from $1.452 billion in Q2 2023.

A-B’s underlying profit through the first two quarters of 2024 stood at $3.32 billion, compared to $2.762 billion through the halfway point of 2023.

The company generated $140 million in revenue via its “digital direct-to-consumer ecosystem” in the second quarter. Around 70% of its revenue came through B2B digital platforms, with its BEES platform now boasting 3.8 million users through the midway point of 2024.

Looking ahead to the remainder of 2024, A-B is forecasting its EBITDA to grow between +4% and +8%.