Three years post-pandemic, the beer industry’s performance is still “erratic,” National Beer Wholesalers Association (NBWA) chief economist and VP of analytics Lester Jones said during a webinar on Tuesday.

Jones and Fintech VP of distributor strategy Eric Kiser delivered a midyear update on the beer category using broad economic figures and Fintech’s cache of invoice data from 233,000 retailers and 5,178 distributors. The nearly 1 million invoices Fintech processes each week represent about one-third of all retailer alcohol transactions.

Here are some highlights from the presentation, which included Fintech data through July 12:

‘Crazy Comps Continue’ 3 Years On

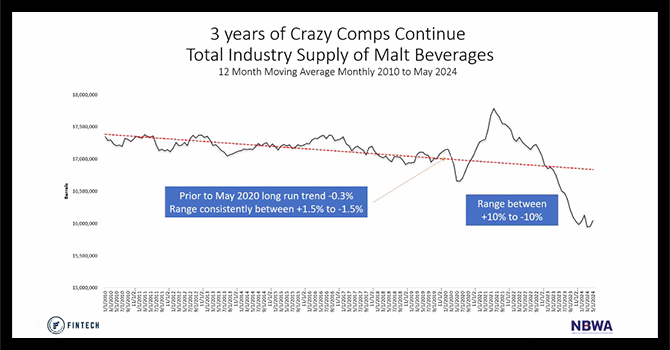

The volume of beer and malt beverages moving throughout the industry remained fairly stable from 2010 through early 2020, with a “long run trend” of -0.3% and shifts “consistently” between +1.5% to -1.5%.

All that changed with the pantry-loading spike of March 2020 when the on-premise shut down due to the COVID-19 pandemic, and volume swings are now nearly 10 times the size of what they were in the prior decade. Since 2020, shifts in volume moving through the industry can range between +10% and -10%.

“The erratic behavior of the beer industry is still there,” Jones said. “We saw a big jump in May, we’ll probably see a big decline in June – we’re still seeing very erratic comps. The industry fundamentally has not normalized or gotten back to an equilibrium or steady state where you can go back to these plus one minus one swings in volume that we used to have pre-COVID.”

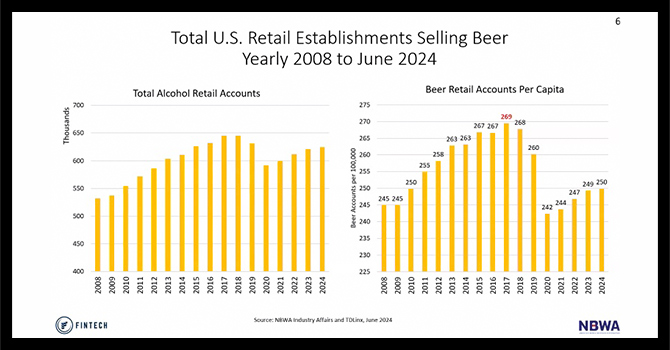

More Beer Retail Accounts Open Each Year, Primarily On-Premise

Each year, more beer outlets have opened as the retail tier claws out of the deficit it entered in 2020. That year, the number of outlets per 100,000 people dropped from 260 to 242.

As of last month, there were 250 beer-selling outlets per capita, according to TDLinx data Jones shared.

“You have established relationships with retailers that have been around for a while,” Jones said. “But at the same time, new retailers are coming into this marketplace every day. And basically, in the last two years, 70% of those new beer establishments have been in dining, bar, nightclub, lodging and recreation. These are the places where our marketplace is growing.”

Of the nearly 21,000 beer-selling retailers that have opened since 2022, 70.2% of them have been in the on-premise channel.

Dining establishments held the largest share of new on-premise establishments (33.6%), followed by bar/nightclubs (14.2%), lodging (10.9%), recreation (6.3%), catering (5.4%), and transportation (0.1%). Only military on-premise accounts declined year-over-year (YoY) at -0.3%.

In the off-premise channel, convenience stores held the largest share of new beer-selling establishments (15.5%), followed by mass merchandisers (11%), liquor stores (9.1%), cigarette outlets (4.5), wholesale clubs (0.3%), and category killers, which are large retailers with a special focus (0.2%). Drug stores posted the steepest decline (-10.1%), followed by grocery stores (-0.7%).

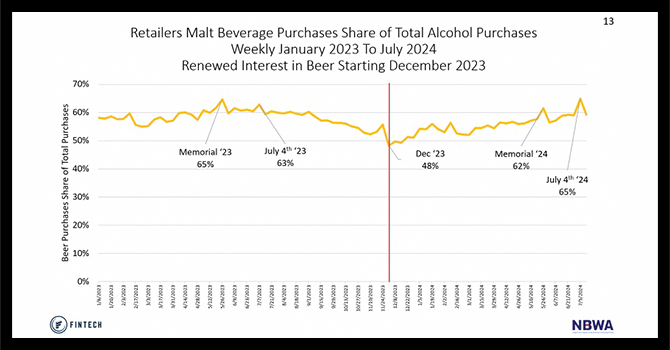

Beer’s Share of Retail Orders Increased Between May and July

In 2023, the share of Fintech invoices pertaining to beer peaked during Memorial Day weekend at 65%, dipped -2% to 63% for the July 4 holiday, and continued a downward slide to the end of the year, when it bottomed out at 48%, Jones said.

This year, beer’s share among invoices hit its first peak at 62% during Memorial Day weekend and increased +3% to 65% for July 4 – marking a departure from last year’s monthslong decline.

“It’s been kind of a beautiful rebirth,” Jones said. “It’s a renewed interest in beer.”

Kegs Gain +5.5% Share On-Premise

In addition to on-premise outlets accounting for the majority of new beer-selling retailers, kegs have also gained share among package formats in the channel. Kegs gained +5.5% in share of Fintech invoices year-over-year (YoY), Jones said.

Kegs, which have struggled since the pandemic forced the closure of bars and restaurants and the on-premise channel began to reevaluate its relationship with draft beer, now account for 50.5% of all Fintech retailer purchases, up from 45% in 2023.

Much of that gain (4.9%) came from bottles, which accounted for 27.3% of purchases, followed by cans at 22.2%.

In the off-premise, cans account for more than two-thirds of retailer purchases (69.4%), up +3.6% YoY. Bottles lost nearly 4% in share and accounted for 30.4% of retailer invoices.

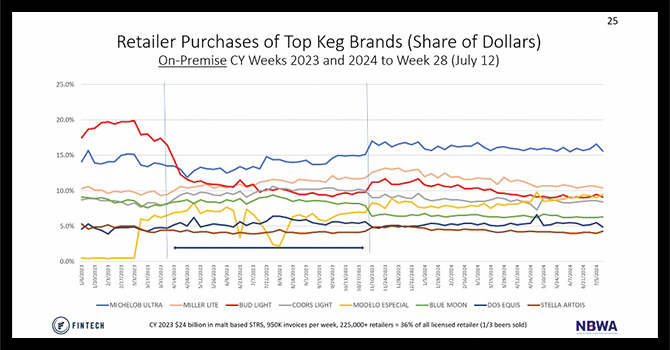

On-premise, 13 suppliers account for 92% of all keg invoices year-to-date (YTD) in 2024. However, the long tail of all other suppliers has gained +1% in share from the leaders this year.

Anheuser-Busch InBev’s (A-B) 10 brands among the top 29 on draft account for 36.6% of all kegs tracked by Fintech. Michelob Ultra (16%) holds the largest share, followed by Bud Light (9.7%), Stella Artois (4.3%), Busch Light (1.5%), Kona (1.4%), Budweiser (1.1%), Goose Island (0.8%), Golden Road (0.7%), Elysian (0.6%) and Michelob (0.5%).

Molson Coors brands accounted for 27% of all keg invoices tracked by Fintech. They include Miller Lite (11.2%), Coors Light (8.5%), Blue Moon (6.4%) and Leinenkugel’s (0.9%).

Constellation Brands was the third largest keg supplier with Modelo Especial accounting for 8.4% of all Fintech-tracked kegs, followed by Pacifico (1.6%). Modelo Especial was the largest keg share gainer, picking up +3.6% YoY, followed by Michelob Ultra (+2% YoY). All other brands were flat or down, with Bud Light (-4%) down the most in the wake of last year’s conservative-led boycotts.

Other keg suppliers among the top 29 brands include:

- Boston Beer with Samuel Adams (2.2%) and Angry Orchard (0.7%);

- Kirin with Bell’s (1.7%) and New Belgium (1.2%);

- Heineken USA with Dos Equis (5.3%) and Heineken (0.5%);

- Yuengling (2.2%);

- Sierra Nevada (1.1%);

- Gambrinus-owned Shiner (1.1%);

- Duvel USA-owned Firestone Walker (0.7%);

- Tilray-owned Shock Top (0.7%);

- Pabst (0.6%);

- Diageo-owned Guinness (0.5%).

Among cans sold in the on-premise, Mark Anthony Brands’ White Claw and Michelob Ultra tied for the largest share at 9.7% each. Michelob Ultra was the most popular brand in bottles sold on-premise, with 17.9% share, up +2.2% YoY.

Other tidbits from the presentation…

- Non-alcoholic (NA) dedicated craft brewer Athletic has usurped Heineken 0.0 as the share leader in off-premise NA invoices. Athletic gained +7.7% in share, to 26%, followed by Heineken 0.0 (19.1%) and A-B’s Budweiser Zero (12.3%).

- Heineken 0.0 remains the NA leader in on-premise invoices with 38.3% share. However, the brand’s share has declined -9.9% YoY, as Athletic (21%, up +5.6%) nips at its heels.

- The long tail of craft has gained share from segment leaders in both the off-premise (+1.7% YoY) and on-premise (+1.8%). Beyond the top 15 brands, all other brands account for 50.4% of off-premise Fintech invoices and 36.9% of on-premise invoices.

- Blue Moon lost share in both the off-premise (-2.2%) and the on-premise (-6.1%). It remains the largest brand in on-premise invoices at 20.1%, but was dethroned by Kirin-owned New Belgium Voodoo Ranger in the off-premise, which gained +1.6% in share, to 8.2%.