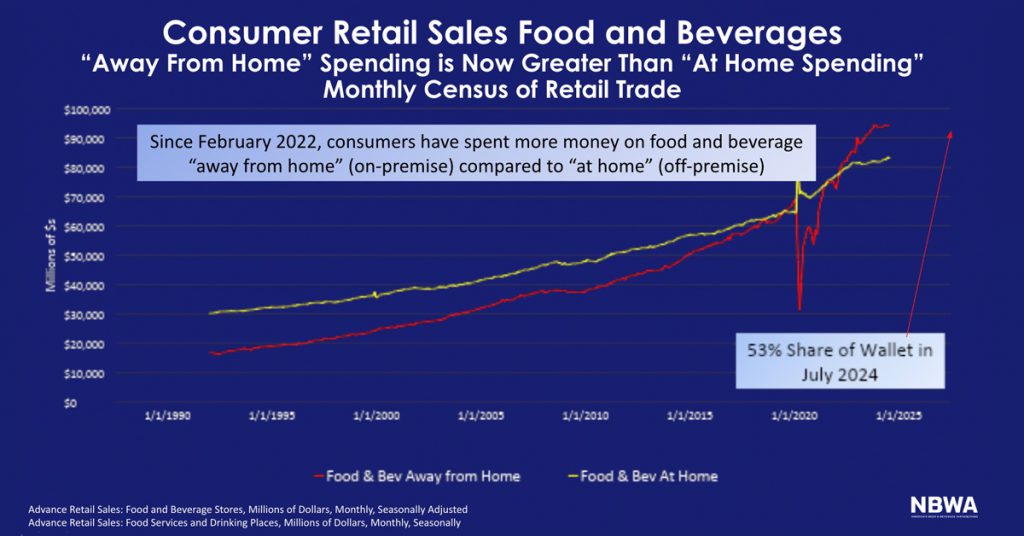

Consumer spending on food and beverages away from home continues to account for the majority of food and beverage costs, National Beer Wholesalers Association (NBWA) chief economist and VP of analytics Lester Jones said during the trade organization’s Annual Convention last week in San Diego.

Away-from-home spending overtook at-home spending in February 2022, and reached a 53% share of wallet in July 2024, Jones said.

“When you look at what happened with all that [federal stimulus] money and all the cooped up demand that was part of the COVID lockdown, what we saw over the last couple years is this tremendous surge in spending away from home and the on-premise,” Jones said.

Alcohol’s share of consumer expenditures has remained steady at 0.8% since 2020, according to data Jones shared from the U.S. Bureau of Labor Statistics. However, the share of alcohol at home vs. alcohol away from home has varied, driven by the COVID-19 pandemic, which sent away-from-home expenditures’ share to 31% in 2020.

Although most breweries’ volume skews more heavily toward the off-premise trade, the on-premise remains a critical channel for the industry.

“A dollar spent at a bar or in a restaurant is nothing like a dollar spent in a grocery store or a convenience store,” Jones said. “They have very different volume impact.”

A one-point share shift toward the on-premise in purchases beer retailers make from wholesalers is equivalent to $700 million, according to Jones’ analysis of data from wholesaler invoicing platform Fintech. Year-to-date (YTD) through September, Fintech-tracked on-premise retailers increased share by +1 point, to 14%. Fintech data accounts for roughly one-third of all beer sold through the three-tier system.

Similarly, a +6-point shift in share from packaged beer to draft at on-premise retailers accounts for an increase of +$42 million, Jones noted, citing Fintech data. Draft reclaimed its majority share of on-premise beer packages in September 2024, accounting for 51% of on-premise sales, up from 46% in September 2023.

Draft beer crushes packaged beer by triple-digit margins in value velocity in a case study of California on-premise establishments, according to Draftline Technologies founder Jennifer Hauke, who joined Jones on stage for part of his presentation. When beer is available both on draft and in package, draft outperforms package by 367%, with an average of $7,238 in value velocity, compared to $1,974 for package, Hauke said, citing CGA data.

The gulf is even wider in certain segments. Domestic premium draft outperforms package by 747%, followed by craft (657%) and domestic super premium (620%), Hauke said.

“Sometimes the consumer is whispering, but I think in this case with draft, we have such a wonderful opportunity in beer to bring new drinkers into the category where draft is available,” she said. “People really want it. And when you look at the numbers by dollar velocity, to me it was actually shocking.”

Industry Leaders Discuss How Beer Can Win in the On-Premise

Before the pandemic shut down bars and restaurants, the ability to drink a beer outside the home seemed to be “everywhere,” including at unexpected places like zoos and libraries, Jones said.

“It was really a renaissance of people’s willingness to have beer in so many great places,” he said. “Clearly, COVID came along, shut everything down, and we rethought our priorities. And coming out of COVID was very package-focused.”

Following his presentation, Jones moderated a discussion among panelists Jim Koch, Boston Beer Company founder; Robbie Maletis, general manager of Portland, Oregon-based Maletis Beverage; and Alex Bergson, VP of New York City-based Manhattan Beer.

Asked what the appropriate balance of draft beer and packaged beer should be, Koch – whose company’s portfolio includes Samuel Adams, Angry Orchard and Dogfish Head, which were all built on draft in the on-premise – said “more [draft] is better.”

However, suppliers and wholesalers often have competing outlooks when it comes to draft service, which can be logistically difficult for wholesalers. When the pandemic shutdown the on-premise and wholesalers turned their attention to the off-premise exclusively, the trucks leaving warehouses stacked with cases were “happy trucks,” a wholesaler friend told Koch.

“Part of the situation we have now is there’s just less pressure from brewers and wholesalers against the on-premise accounts, particularly selling draft,” he said. “There’s probably 30% of the craft beer salespeople that we had pre-COVID [that] aren’t there anymore.

“To me, the on-premise is one of the biggest opportunities in beer,” Koch continued. “But it’s an opportunity wrapped in a challenge, because it’s often not profitable for wholesalers. That’s the other elephant in the room. Brewers can’t really ask wholesalers to make unprofitable stops.

“So we need, as an industry, to work together and find a solution where brewers maybe do more than they’re doing now, and wholesalers understand that draft and on-premise drives off-premise.”

For Manhattan Beer – whose portfolio includes Molson Coors, Constellation Brands, Boston Beer, Mark Anthony Brands, Heineken and Diageo, as well as other craft suppliers – the ideal number of tap handles per account hovers between 12 and 14, Bergson said.

“When you get beyond that, it’s just difficult to maintain quality, maintain freshness, maintain the standards that you want in the on-premise,” he said. “That’s how, to what Jim is getting at, we can win in the on-premise, with all those attributes, and it isn’t possible to do that when you have a proliferation of draft lines.”

When Maletis reps are assessing retailers’ draft lineup, they work with accounts to determine if proposed new products can deliver “incrementality,” and what the right product mix is to meet patrons’ needs, Maletis said.

“It’s just as much a conversation of, ‘How do we make that draft line up categorically most attractive to the consumer?’ as it is of, ‘How many handles do we want?’” he said.

Koch called for fellow suppliers to reframe their view of the on-premise as a marketing tool, rather than just a sales channel.

“We all believe that on-premise drives off-premise,” he said. “So when we look at holistically where we spend our money, I’m thinking ‘Gee, what’s going to give me a better return – $10 million more in social media, or 75 on-premise salespeople that make their eight or 10 calls a day, 75% of them on-premise. Which is a better marketing spend?’

“So we’re willing to take our marketing budget and spend that in our wholesaler’s market on people who call on accounts,” Koch continued, adding that Boston Beer has eight sales reps in Manhattan alone.

In the Pacific Northwest, Maletis’ on-premise team has gone back to basics and is using tried-and-true promotional tools like happy hours and pricing specials with bars and restaurants, Maletis said.

“As we find ourselves in a business consultant perspective, what we really want to do is help them drive traffic,” he said. “We want to be great advocates and stewards for the on-premise industry. We want people in the seats giving them the opportunity to try our products, both products that they’ve had for years and they buy off-premise, for example, or products that are new-to-world, or in that fourth channel that’s growing so rapidly.”

In the past half-decade, on-premise retailers have developed a larger appetite for cans of fourth category offerings, such as hard seltzers, spirits-based ready-to-drink (RTD) canned cocktails and flavored malt beverages (FMB), Koch said. He admitted that in the early days of Twisted Tea, the company “didn’t bother” with the on-premise, assuming that bars “want to sell a mixed drink.” But the convenience of these packages is attractive to high-volume accounts, because “bartenders cost money” and “napkins and straws and toothpicks cost money.”

“If you’re slammed, you can throw a can of [Boston Beer’s vodka-based hard tea] Sun Cruiser over the bar,” Koch said.

The proliferation of fourth category products has created a bev-alc landscape for younger legal-drinking-age (LDA) consumers that is far different from the one prior generations encountered when they came of age. An explosion of options may be drawing new LDA drinkers’ palates away from beer.

“Beer has a lower badge value right now than a lot of other products out there,” Bergson said. “Anything that we can do to help bring it back and make it cool again to have a beer in your hand is going to turn the tides.”

Elevating beer through experiential marketing could be one way to reach younger LDA adults.

“That younger generation is really looking for not just social occasions, like in a bar or a restaurant, but they like to spend their time and money on unique experiences,” Maletis said.

Just before the NBWA Annual Convention kicked off, Boston Beer’s Samuel Adams sponsored an Oktoberfest celebration in Manhattan’s Greenwich Village. Two dozen bars hosted stein hoisting contests and other promotions, Koch said. Events such as this one and beer dinners could meet younger LDA consumers’ desires for experiences while telling them beer’s story.

“We should not forget how important those things are to continue to elevate beer to something more than just alcoholic soda pop, to something with history and variety and complexity and dignity and even nobility,” Koch said. “I think that continues to be appealing to LDAs.”