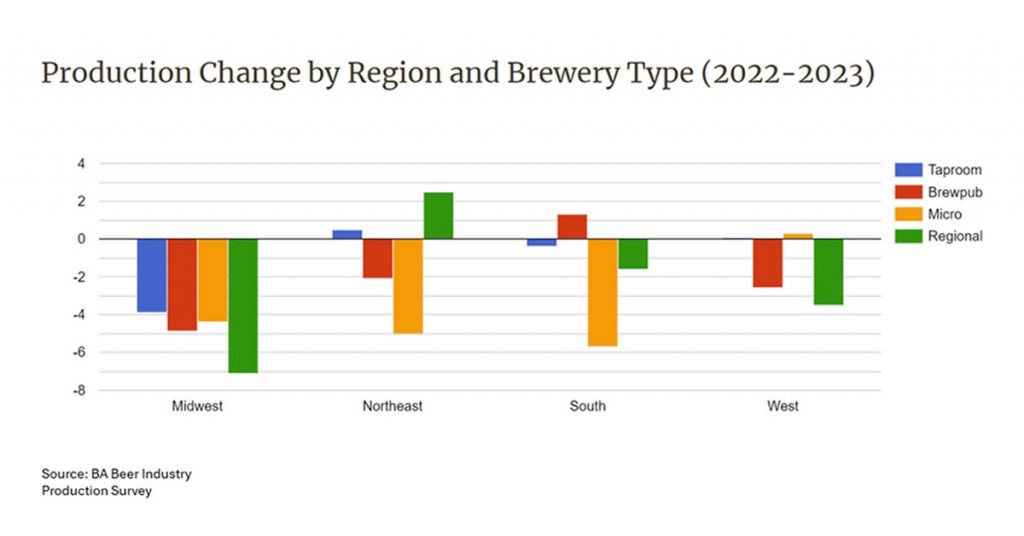

Last year’s overall craft volume decline was felt more acutely in the Midwest than other regions, according to a recent report from Brewers Association (BA) staff economist Matt Gacioch.

Overall craft volume declined -1% in 2023, the first year output was down other than 2020, when the COVID-19 pandemic upended the craft beer industry and constricted many producers’ ability to sell in the on-premise and at-the-brewery channels.

Midwest craft brewers recorded the steepest decline at -6% year-over-year (YoY). The Northeast was the only region to increase volume (+1%).

The BA defines the Midwest as the following states: Ohio, Michigan, Indiana, Illinois, Wisconsin, Minnesota, Iowa, Missouri, Kansas, Nebraska, South Dakota and North Dakota. The Northeast includes Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut, New York, New Jersey and Pennsylvania.

Volume declines were about -2% in both the South (Texas, Oklahoma, Arkansas, Louisiana, Mississippi, Alabama, Tennessee, Kentucky, Delaware, Maryland, Virginia, West Virginia, North Carolina, South Carolina, Georgia, Florida, and Washington, D.C.) and the West (Washington, Oregon, California, Alaska, Hawaii, Montana, Idaho, Wyoming, Colorado, Utah, Nevada, Arizona, and New Mexico).

The BA classifies members into four groups:

- Taproom breweries, which sell at least 75% of their volume on their own premises but do not offer significant food service;

- Brewpubs, which sell at least 75% of their volume on their own premises and operate restaurants;

- Microbreweries, which produce fewer than 15,000 barrels of beer annually and sell at least 75% of it off their own premises;

- And regional breweries, which produce between 15,000 and 6 million barrels of beer annually and sell at least 75% of it off their own premises.

The Midwest was the only region in which all four classes of breweries posted volume declines. Midwestern regional breweries collectively recorded the steepest YoY volume decline at -7.1%, followed by brewpubs (-4.9%), microbreweries (-4.4%) and taprooms (-3.9%).

At +2.5% YoY, Northeastern regional breweries recorded the largest growth, which “was buoyed largely by a few large producers that had a blockbuster year in 2023,” Gacioch wrote. Northeastern taprooms also eked out growth (+0.5%), making it the only region to have more than one class of brewery with a volume increase. Northeastern microbreweries recorded the third steepest decline nationwide (-5%), and volume at brewpubs in the region declined -2.1%.

Microbreweries in the South posted the second steepest decline at -5.7% YoY. The region’s brewpubs were the only to record volume growth (+1.3%). Southern regional breweries’ volume declined -1.6%, and taprooms declined -0.4%.

In the West, taprooms (+0.05%) and microbreweries (+0.3%) were essentially flat, while volume at brewpubs (-2.6%) and regional breweries (-3.5%) both declined.

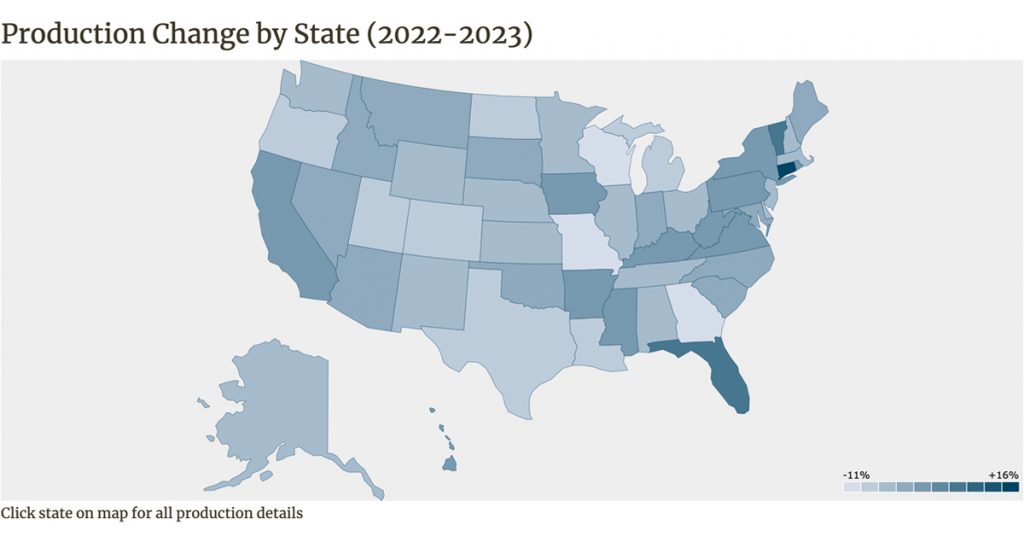

Connecticut, Vermont and Florida Lead State-Level Growth

At the state level, Connecticut recorded the strongest overall volume growth (+16.1%) driven by the regional brewery segment, which increased volume +28.7%. Connecticut is home to one of Athletic Brewing’s production facilities, which is likely pushing the state’s growth to outpace the rest of the country. The non-alcoholic craft brewer’s output increased +51% in 2023.

The state has two other regional breweries: Stratford-based Two Roads, which recorded flat volume in 2023, and Woodbridge-based New England Brewing, which increased volume +5%.

Connecticut’s taproom breweries’ volume increased +2.8%, but volume from both brewpubs (-6.7%) and microbreweries (-3.9%) declined, according to the BA.

Vermont recorded the second highest volume gains last year, increasing overall volume by +6.9%, driven by the state’s regional breweries (+8%). Two of the Green Mountain State’s five regional breweries recorded double-digit volume growth: Shelburne-based Fiddlehead (+23%) and Burlington Beer Company (+42%).

Vermont’s microbreweries increased volume +6.1%, led by Burlington-based Foam Brewers (+56%) and Hinesburg-based Frost Beer Works (+19%). The state’s brewpub class was flat (+0.3%), and its taprooms’ volume declined (-5.3%).

Florida posted the third largest volume growth in the country, with overall gains of +5.3%, driven by taprooms (+6.9%). None of the state’s larger taprooms – those producing more than 1,600 barrels annually – recorded growth larger than +5%, indicating smaller taprooms have likely contributed to the class’s growth. The BA does not publish year-over-year comparisons for taprooms and brewpubs producing fewer than 1,600 barrels.

Regional breweries in the state increased output by +6.4%, driven by Wesley Chapel-headquartered Florida Avenue Brewing (+35%).

Sunshine State brewpubs’ volume increased +5.5%, but none of the state’s six brewpubs with volume greater than 1,600 barrels recorded growth, suggesting the smaller businesses are driving gains.

Microbreweries in Florida were roughly flat (-0.6%).

Wisconsin craft breweries recorded the steepest volume declines in the country (-11%), driven by the state’s regional breweries, which declined -15.8% overall. All four of Wisconsin’s regional breweries posted declines to varying degrees.

Monroe-based Minhas, the country’s 29th largest craft brewery by volume, saw its output decline -44%, followed by Milwaukee-based Lakefront (-11%), Stevens Point Brewery (-5%), and New Glarus Brewing (-1%).

Wisconsin microbreweries’ volume declined -5.6%, driven by Potosi Brewing (-38%) and Waunakee-based Octopi’s Untitled Art (-35%). Taproom breweries’ volume declined -2.9%, driven by taprooms making fewer than 1,600 barrels annually.

Badger State brewpubs’ volume increased +9.4%. Seven of Wisconsin’s 11 brewpubs with annual production greater than 1,600 barrels recorded double-digit increases in output in 2023, led by Madison-based Young Blood Beer (+38%), Muskego-headquartered Eagle Park (+29%) and Milwaukee-based MobCraft (+27%).

At -10.8%, Georgia recorded the second steepest volume declines, driven by the state’s microbreweries (-14.3%). As microbreweries producing 6,000 barrels or more recorded small declines (-2% each for Decatur-based Three Taverns and Alpharetta-based Jekyll Brewing) or double-digit growth (+80% for Decatur-headquartered Wild Heaven), the decline is likely driven by smaller producers.

Georgia’s regional breweries (-11%) and brewpubs (-10.4%) also recorded double-digit declines. Volume from the state’s taprooms declined -4.4%.

Missouri’s craft breweries overall posted volume declines of -9.1%, driven by its regional breweries (-10.6%). Output at all three of the state’s regional breweries, led by St. Louis-based Schlafly (-27%). St. Louis-based 4 Hands (-9%) and Kansas City-based Boulevard (-6%), which is owned by Duvel Moortgat USA, followed.

Brewpubs (-7.2%), microbreweries (-6.1%) and taprooms (-5.3%) in Missouri all recorded volume declines.