Dan Wandel, senior vice president of beverage alcohol client relations for IRI, provided an in-depth look into various regional retailing trends during last week’s “Power Hour” conference call, hosted by the Brewers Association. Despite positive overall movement, many prominent craft brands, like Widmer Hefeweizen and Sierra Nevada Pale Ale, saw their share decline in some regions.

Nationally, the top 15 craft brands have accounted for 35 percent of craft’s year-to-date dollar sales in IRI-tracked supermarkets. But their share is slowly declining, said Wandel, who noted that the top 15 craft brands accounted for 36.6 percent of supermarket sales through July 15, 2012.

While those top tier brands might be losing some of their share in supermarkets — largely due to increased competition from smaller suppliers —their overall sales are still growing, up more than $19 million through July 14. In fact, 13 of the top 15 craft brands achieved positive year-to-date dollar sales growth in the channel.

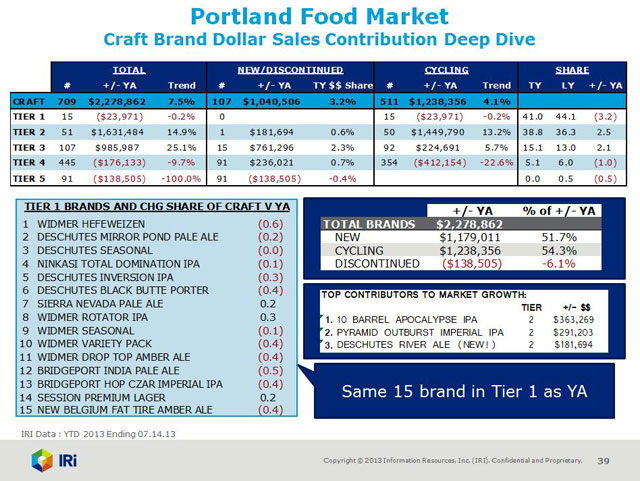

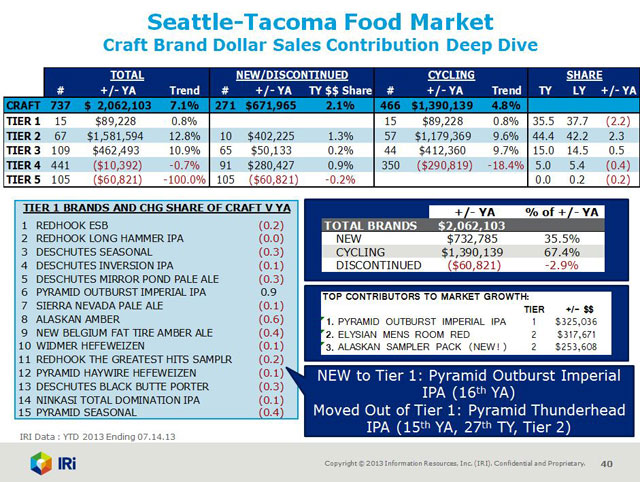

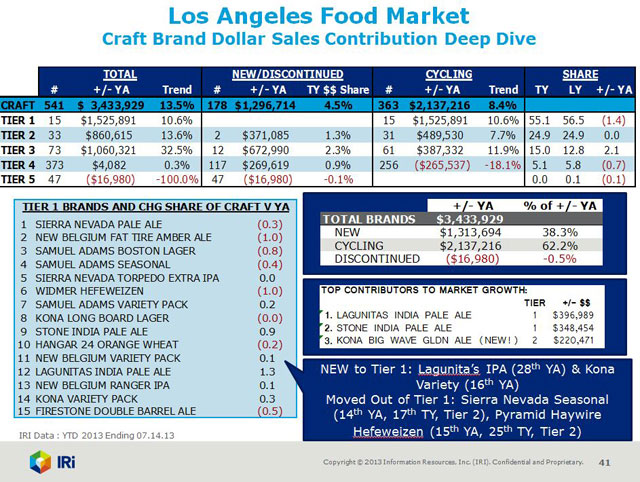

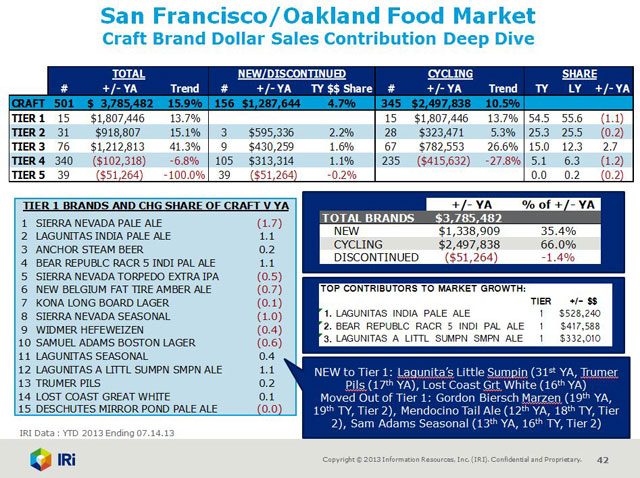

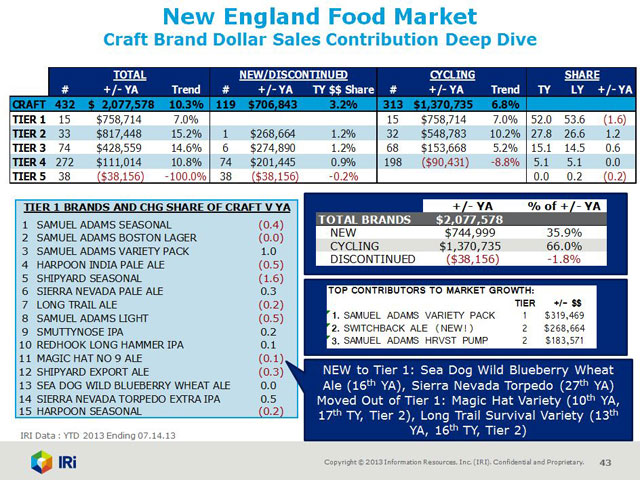

But there were some interesting variations, even within markets.In his presentation, Wandel highlighted five popular craft markets — Portland, Ore., Seattle-Tacoma, Los Angeles, San Francisco/Oakland and New England — breaking out hundreds of craft brands into four groups. The top two groups accounted for 80 percent of total dollar sales in supermarkets, while brands in tiers three and four accounted for the remaining 20 percent of sales.

In Los Angeles, dollar sales for the top 15 were up 10.6 percent and in San Francisco they were up 13.7 percent.

So what’s different about Portland?

For one, Portland’s top 15 best-selling brands from 2012 remained unchanged in 2013.

“What this says is that these 15 brands, in that market, are very significant in terms of the craft segment,” he said.

In every other market that Wandel identified during the call, new craft brands broke into the each region’s top 15. But amongst Portland’s top 15, only three — Sierra Nevada Pale Ale, Widmer Rotator IPA and Full Sail Session Lager — saw positive share gains. But there’s a broader marketplace there: the next 51 best-selling brands in Portland supermarkets were up 14.9 percent. Dollar sales for the subsequent 107 brands were also up 25.1 percent.

There are losers, too, and they’re the little guys: dollar sales for the bottom 445 brands, which accounted for just 5 percent of craft’s total sales in supermarkets through July 14, were down 9.7 percent in Portland. It’s a similar story in Seattle, where dollar sales of the smallest 441 brands were also down 0.7 percent in supermarkets during the same period. Wandel believes that some of those brands could be sold in single-serve formats, which have a slower velocity. He also said that many smaller craft brands focus on selling in the liquor or convenience channels, areas not included in the report.

Seattle’s top 15 craft brands haven’t fared much better than Portland’s. Brands like Pyramid’s Outburst Imperial IPA and Alaskan Amber have each lost more than half of a share point in Seattle supermarkets.

The growth of hop-forward styles in L.A. and S.F. makes sense. IRI data, supplied to Brewbound.com following last week’s call, shows style trends in each of the five regions. The top performing style in both Los Angeles and San Francisco markets was IPA, up 47.9 and 38 percent respectively, the highest of any region.

“Big suppliers like Lagunitas and Sierra Nevada are key contributors,” Wandel said.

In L.A. supermarkets, IPAs have already generated more than double the amount of dollar sales than the no. 2 craft style, variety packs, through July 14 ($7.1 million compared to $3.4 million).

For a more in-depth snapshot of craft’s performance in supermarkets through the first half of 2013, take a look at the IRI graphs below, which depict craft’s dollar sales contribution and the top 15 brands in each of the five above-mentioned markets.