The number of craft beer drinkers who are drinking less craft beer than they were a year ago has surpassed the number of those who are drinking more for the first time since the Brewers Association (BA) started asking this question in its annual poll in 2015.

BA chief economic and VP of strategy Bart Watson and staff economist Matt Gacioch shared the findings of the BA’s ninth annual Harris Poll during a Thursday webinar. Nearly 2,100 legal-drinking-age Americans were surveyed about their drinking habits.

“In 2015, people were leaning in, they were moving more centrally into the category,” Watson said. “In 2024 there’s more of a balance between people leaning out – and we’re going to talk about all the other stuff they’re drinking in a second – and people who are still leaning in.”

This year, 26% of respondents said they were drinking less craft beer in 2024 than they were in 2023, compared to 25% who said they were drinking more. Last year, these groups were in equilibrium for the first time.

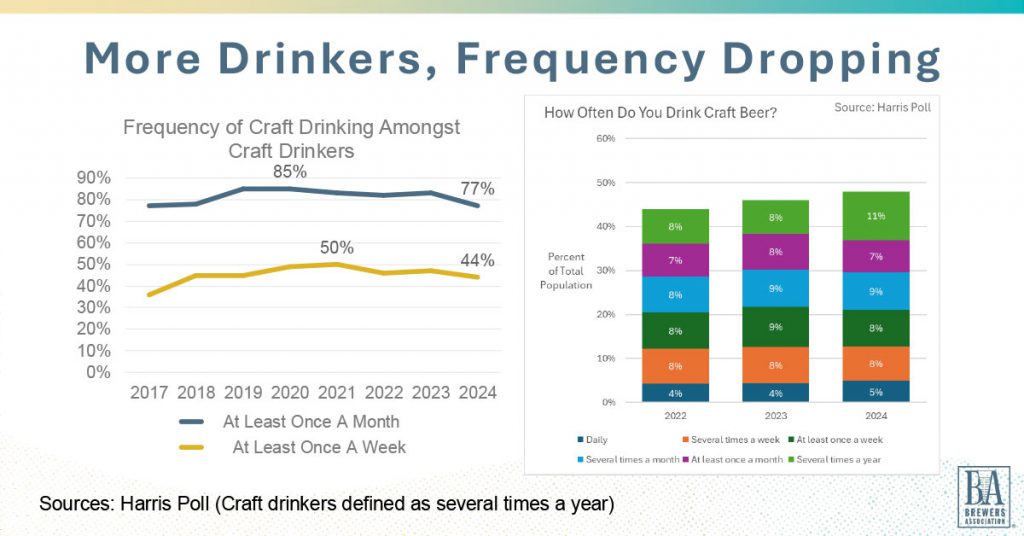

The percentage of craft beer drinkers – those who drink craft beer “several times a year” – who consume craft beer monthly has declined to 77%, down from a 2020 peak of 85%. Those who drink craft beer weekly has declined to 44%, down from 50% in 2021.

Some craft drinkers may be drinking less, but there are now more of them than in previous surveys. Nearly half (48%) of Harris Poll respondents drink craft beer “several times a year or more often,” and 9.1% of respondents in a 2022-2023 Scarborough USA survey said they have drunk craft beer in the last 30 days. The earliest data for each poll (2014 for the Harris Poll and 2012-2013 for Scarborough USA) tracks those metrics at 32% and 6.6%, respectively.

“Even as craft growth has stalled in recent years, the percentage of people who say they’re purchasing craft in the last 30 days, or drinking craft at least several times a year, is still going up,” Watson said. “So that slowdown isn’t necessarily driven by the size of the total pie. It’s going to be driven by other things.”

Watson and Gacioch delved into why craft drinkers are drinking less craft beer and why other drinkers may be less inclined to pick up their slack in a jam-packed webinar. Here are some highlights:

Craft Drinkers are More Omnibibulous than Most Bev-Alc Consumers

People who drink craft beer also drink across beverage-alcohol, according to a frequency correlation chart Watson and Gacioch shared. On a scale of 0.0-1, craft beer has its closest correlation with imports (0.7) and domestic beer (0.61), followed by hard cider (0.56), ready-to-drink (RTD) canned cocktails (0.55), hard seltzer (0.54).

“People drinking craft more frequently are more likely to drink frequently in a lot of other categories,” Watson said.

Craft is less closely correlated to flavored malt beverages (FMB) with a rating of 0.5, spirits (0.46) and wine (0.41).

Drinkers of wine and spirits are more likely to stick to their preferred categories and have fewer correlations than other bev-alc categories and segments.

Of the major bev-alc categories, beer drinkers dominate at both ends of the frequency spectrum. Beer claims the highest rates of drinkers who consume it daily (about 9%), several times a week (about 16%) and never (about 20%).

Spirits claimed the largest percentage of drinkers who consume at least once a week (nearly 15%), several times a month (15%), several times a year (about 18%), and once a year or less often (10%). Wine only claimed the largest percentage of drinkers who consume at least once a month (about 15%).

But the most frequent drinkers – which some beer drinkers are – are also the most omnibibulous, meaning they drink across segments and categories. Half of all weekly drinkers are consuming from three or more categories of products, the Harris Poll found.

“The most frequent beverage alcohol consumers, those who are drinking weekly, are the ones were the most omnibibulous who are drinking across categories, because half of them tell us they’re drinking weekly in three or more categories,” Watson said. “Craft is really the archetype of this, but our core customers are ones who are really looking across beverage alcohol and looking to drink a lot of different places.”

Between 2019-2024, weekly consumption rates have increased for every category and segment (wine, domestic non-craft beer, spirits, imported beer, FMBs, hard seltzers and hard cider) but craft beer.

Craft More White and Male than Other Bev-Alc Segments

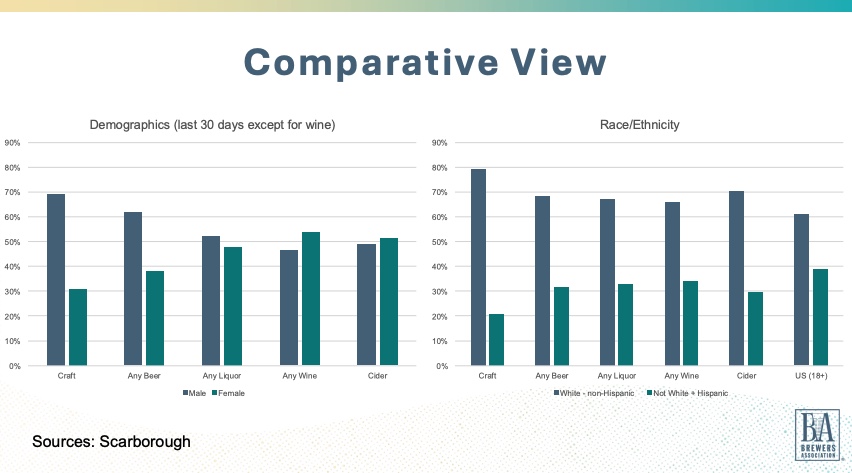

Demographic divides in craft beer along both race and gender lines are starker than in other bev-alc categories.

Craft beer drinkers are 70% male and 30% female, compared to overall beer, which is closer to a 60/40 split, according to Scarborough data. Liquor leans slightly more male, while wine is slightly more female. Cider is close to 50/50.

Nearly 80% of craft drinkers are white, and slightly more than 20% are not white. Overall beer, liquor, wine and cider are all roughly 70/30, while American adults are about 60/40.

Craft beer drinkers’ gender divide has remained steadily about 70% male and 30% female since the first Scarborough USA poll was conducted in 2012-2013. The gap closed by a few percentage points in the 2018-2019 survey, but began to widen again in 2020-2021.

Non-Craft Drinkers Say They ‘Don’t Like the Flavor’

Of the 29% of the population who drinks alcohol – excluding craft beer – several times a year, more than 50% said they avoid craft beer because they “don’t like the flavor,” which far surpassed other reasons. This dislike of the flavor of craft beer is more highly concentrated among drinkers aged 21-34, who are 13% more likely to dislike the flavor of craft than drinkers 35 or older, according to the survey.

Thirty percent of non-craft drinkers said they prefer other beverages, and about 25% said they prefer other alcoholic beverages. About 18% said craft is too expensive, and about 15% said they “don’t know enough about craft options to decide what to consume.”

All other reasons for not drinking craft beer were selected by less than 10% of respondents, including:

- “I am opting for a healthier lifestyle overall;

- I prefer higher alcohol content beverages;

- I prefer to drink non-alcoholic beverages instead;

- I am cutting back on overall calorie consumption;

- I prefer lower alcohol content beverages;

- And it has too much carbonation.”

When excluding respondents aged 35 and older, both preferring high alcohol content (+8%) and lower alcohol content (+7%) rated as more important than with the broader group.

Seventy percent of women aged 21-34 who don’t drink craft beer say it’s because they “don’t like the flavor.” This group “is the driving force for the flavor discussions,” Gacioch said.

“Men of that age group are much more likely to say they prefer other beverages instead, especially other alcoholic beverages, and also much more likely to say they prefer lower alcohol content beverages as well,” he continued.

New Beer Brands Declining, But Drinkers Think There’s ‘Enough’

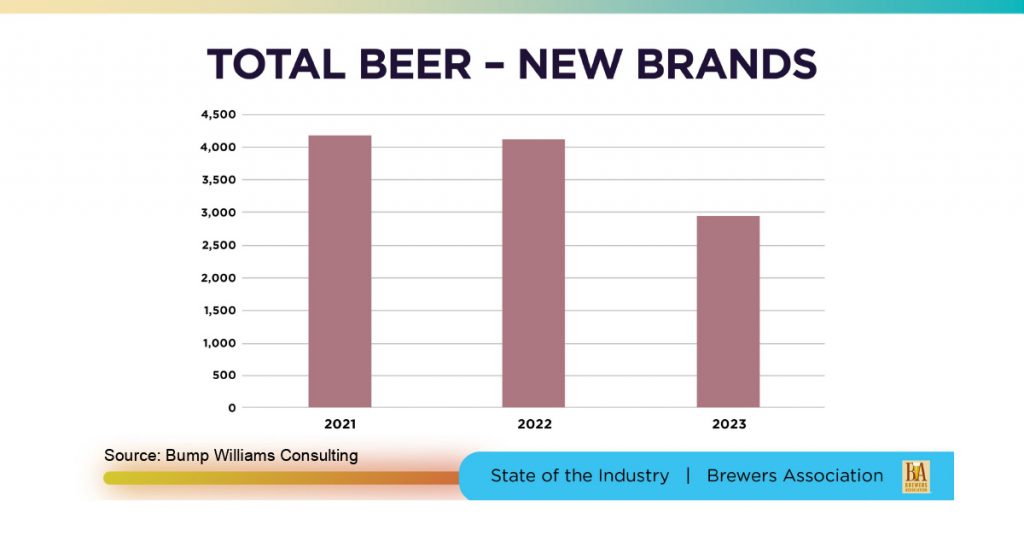

The number of new beer brands available at retailers declined by more than 1,000 between 2021 and 2023, according to Bump Williams Consulting data shared by Watson.

However, 38% of Harris Poll respondents said there was “too much/more than enough” about total items; 37% said there was “too much/more than enough” for brands.

“Consumers reacted to 1,000 fewer new brands going out there with pretty much the same responses that they gave us the year before,” Watson said, adding that “this should be somewhat alarming to craft beer producers.”

“We saw the variety of new products going into the marketplace get slashed – a lot of that coming from craft – and customers pretty much said ‘eh,’ and they didn’t really change,” he continued. “What we would have loved to see is that spike of ‘Well, there’s not enough anymore, because of these brands getting cut.’”

Brewery Visitors Less Likely to Purchase Beer After a Visit on the Rise

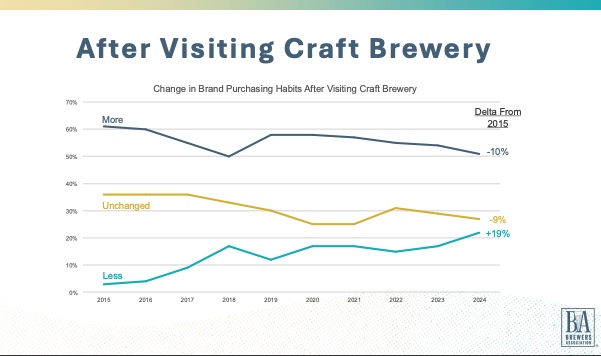

Since the inception of the BA’s Harris Poll, the survey has asked consumers if they are more or less likely to purchase beer from a brewery at retail after visiting the brewery’s taproom. While people who say they are more likely to purchase still outnumber those who do not, the latter number has increased by +19% since the 2015 poll, Gacioch pointed out.

In 2024, about 21% of respondents said they were less likely to seek out a brewery’s beer following a visit, up from just slightly more than zero in 2015.

A little more than half said they were more likely to seek out beer after a brewery visit in 2024, down -10% from 2015.

Several factors could be at play here – including that consumers are visiting breweries that do not distribute and so cannot find their beers at retail, Gacioch pointed out.

“In an environment where there’s so much variety, there’s so many options, we’re thinking that that could be connected to folks who go and visit a brewery and say, ‘OK, great, I’ve been there and now I can try something new,’” he said. “It’s really a call to action to think about what is going to bring those customers back in a saturated market.”