Craft industry members are constantly asking about “price elasticity,” according to Brewers Association (BA) chief economist Bart Watson in his latest deep dive for the trade association.

Price elasticity refers to the relationship between price changes and volume changes. A lower price elasticity means that a segment can increase price more with less impact on volume growth, while a higher price elasticity means that consumers are more sensitive to price increases.

Craft has typically had a lower elasticity than other “lower-priced categories of beer,” but “given changes in U.S. inflation and craft category demand, I think it’s worth discounting historical findings and digging into the current situation,” Watson said.

“Overall price inflation and the proliferation of choices within craft, coupled with lots of new competition in beverage alcohol, has clearly made some consumers think about price more in their purchasing decisions,” he continued. “Including, price elasticity has gone up.”

That news is likely not a surprise for many industry members, as craft price increases have been less than “overall food and beverage pricing” in recent years, Watson said. However, elasticity isn’t a hard and fast rule to make business decisions around, he added.

To highlight the range in price’s impact, Watson explored national and regional trends across both the on- and off-premise channels.

To measure the impact in the on-premise, Watson looked at pint pricing, citing data from Arryved, a craft-centric point-of-sale (POS) provider. In 2023, the average price of a pint of craft beer increased +4.6% year-over-year (YoY), according to Watson. However, when looking at price increases by location, price increases vary significantly.

The majority of locations (60%) had a YoY pint price increase between +2% and +8%. At the same time, 40% of locations had either a +10% or more increase in price, or had a price decrease.

“Note: We are looking at the location level, so we can’t look at pricing by brand, so this might include some shift in brand mix,” Watson said.

Watson also looked at Arryved pint data split by three regional categories: urban, suburban and rural:

- Urban areas, which had an average income of $87,187, recorded a +2.36% average increase, to $7.32;

- Suburban areas, which had an average income of $85,174, recorded a +4.21% average increase, to $7.55;

- Rural areas, which had an average income of $74,470, recorded a 5.68% increase, to $7.76.

“This analysis created a surprise, at least to me,” Watson said. “Not only was rural pint pricing higher in 2023 than urban or suburban, it also grew faster as well. This can’t be explained by income levels, since for the zip codes covered, urban areas had higher income.”

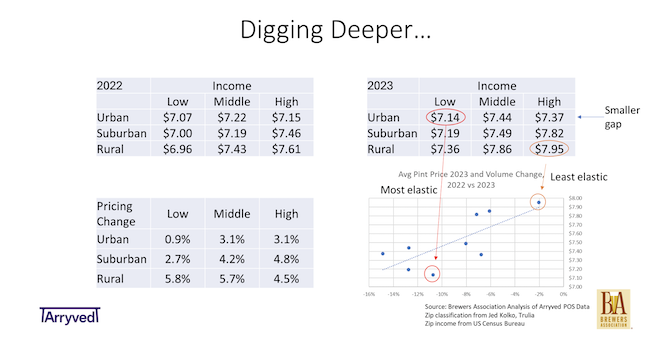

To see the impact of those price increases on consumer buying habits, Watson divided each region into low-, middle- and high-income areas and analyzed how price impacted volume.

Wealthy rural areas had the lowest price elasticity, with the average price of a pint increasing +4.5% YoY, to $7.95, but volume dipping only -2%. Meanwhile, in poorer urban areas, price increased less than 1% (+0.9%), to $7.95%, and volume decreased -11%, suggesting higher price elasticity/sensitivity.

“This data starts to fill out the story of how craft pricing strategy can’t be fixed, but has to be viewed in context of things like location and customer base,” Watson said.

Zooming out to national trends and the relationship between price and volume, Watson compared the YoY change in average pint price per location to the YoY change in quantity of pints sold:

- A price increase above +10% had an average decrease of -5.1% in the quantity of pints sold;

- A +5% to +10% price increase resulted in an average decrease of -2.3% in pints sold;

- A 0% to +5% price increase resulted in a -3.9% decrease in pints sold;

- And a price decrease results in a -0.8% decrease in pints sold.

The median elasticity was -0.59, “meaning a 1% increase in price relates to a decrease in demand of -0.59%.”

“This implies that there’s a general relationship with volume,” Watson said.

“Note that I say ‘relationship’ as opposed to using causal language,” he continued. “One thing that’s really hard to know in these types of analyses is how much pricing affects trends versus how much trends affect pricing. A growing brand gains scale, which means you might want to lean in with more aggressive pricing. Maybe a location losing volume is increasing price to compensate.”

For the off-premise, Watson focused on IPA substyles to avoid impacts on data unrelated to price, such as changes in style demand. He analyzed YoY case equivalent pricing and volume changes for the top 100 brands in Circana-tracked off-premise channels in each of three substyles: American, imperial and hazy/juicy IPA.

The result was that the relationship between price and volume is “pretty weak,” suggesting that other factors such as brand strength “matter as much if not more than pricing.”

Half of the total brands that cut price by -1% or more recorded an increase in volume in 2023. At the same time, 30% of the brands that recorded anything from “slight cuts” to price, to +6% increases, also recorded volume growth. Twelve percent of brands that had price increases of +6% or greater also recorded an increase in volume.

“Similar to pint pricing, this suggests basic ranges that may shift customer decision making, though you should be balancing those buckets with a range of other factors,” Watson said.

The relationship also varied by style, with imperial IPA brands being less impacted by price, while American and hazy IPAs are more price elastic.

Of the 17 American IPAs that recorded a YoY decrease in price more than -1%, 79.5% increased volume. For Hazy IPAs with the same decreases, 56.7% of the 30 brands grew volume, while 34.2% of the 38 imperial IPAs in the same range grew volume.

On the higher end of the price increase spectrum – brands that increased case equivalent prices +6% or more YoY – American IPAs had 9.4% of the style’s 32 relevant brands increase volume; Hazy IPAs had 16.1% of the 31 relevant brands increase volume; and imperial IPAs had 11.1% of its 36 relevant brands increase volume.

“There isn’t one elasticity for craft,” Watson said. “There are multiple by brand, style, location, and more, and so the more you’re really zeroing in on pricing decisions for particular beers and locations, the more you’ll be able to make the best decisions for your business.”