Restaurant Sciences — which tracks food and beverage products sales throughout North America — said that volumes sales of craft beer in September, October and November declined an average of 6 percent versus a year ago.

But those figures contrast with data from GuestMetrics, which peg Brewers Association-defined craft beer up 3.8 percent year-to-date and 4.1 percent for the 4-week period ending November 3. Bart Watson, the Brewers Association staff economist, said he is skeptical of Restaurant Science’s data set and questions how the firm defines craft beer and its sample size.

“There have been some other data streams that suggest getting draft handles is becoming more difficult,” he said. “But based on production trends we saw through June and other data sources, I find it hard to believe that BA-defined craft is experiencing a decline of that magnitude.”

Kris Baker, the senior vice president of sales and marketing for Restaurant Sciences, said it defines craft beer as companies producing less than 50,000 barrels annually, but it also includes companies like Yuengling, Boston Beer, New Belgium and other independent breweries in its sets. Culling a database of more than 1,000 craft beer families and 5,700 craft beer brands, Restaurant Sciences — which tracks nearly $1.5 billion per month in guest check-level sales — said it recorded lower volumes for more than half of the products it tracks in on-premise retail establishments. And, while new craft brands are still being introduced, the number of craft beers sold on-premise has decreased an astonishing 19 percent versus a year ago, the company said.

“The weakness in craft beer volume sales could be due to a number of factors,” Chuck Ellis, the president and CEO of Restaurant Sciences said in a press release. “Consumers may be balking at price increases in the three to seven percent range this fall across restaurants, bars and nightclubs. Additionally, restaurants and bars may have reached a saturation point in adding new beers to an already hyper-competitive shelf or tap set.”

Watson admitted that on-premise craft beer gains have been slower in 2013, but said he disagrees with the 19-percent declines that Restaurant Science is reporting.

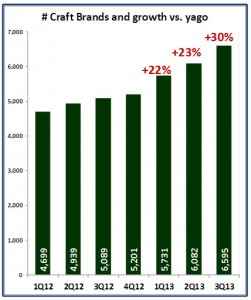

Peter Reidhead, the vice president of strategy and insight for GuestMetrics, also believes the number is inaccurate. He pointed to the latest GuestMetrics data, which shows the number of craft brands being sold on-premise up 30 percent (to over 6,595) through November.

“We are pretty confident about our numbers,” he said. “When we look at specific brands like Lagunitas and compare their growth rates to our figures, it matches up very closely.”

GuestMetrics, which uses the Brewers Association definition for its craft beer reporting and pulls from a database of more than $8 billion in sales, said that a majority of those 6,595 brands are growing. While volume growth for the top 20 craft brands is down 2.1 percent through November, the next 6,000-plus brands are collectively up 7.9 percent, Reidhead said.

“We have never seen craft volumes dip into negative territory,” he said. “While it has slowed a fair amount for the most recent 4-week period (+1.7 percent through Dec. 1), it is still clearly positive for the full-year. It is still taking aggressive share from the overall beer category. Craft has gained 2.1 points of share from the overall beer category year-to-date.”

Restaurant Sciences, on the other hand, claims that at family dining establishments — restaurants with and average guest check of less than $32 — craft beer volumes are down 13 percent. Even at white tablecloth restaurants, which the company defines as having an average guest check of more than $122.50, sales of craft beer are down 10 percent. The company also said more than 70 percent of the declines are in draft volume sales.

Both Reidhead and Baker would not speculate on the discrepancies between the two reports.

GuestMetrics said its sample currently represents a broad bar and restaurant base, 30 percent of which is from chains and 70 percent independently owned. In terms of types of establishments, 68 percent are casual dining, with fine dining, bars and lodging each comprising about 10 percent. Restaurant Sciences, meanwhile, said 50 percent of the beer dollars it tracks come from full-service restaurants while 30 percent comes from bars.