U.S. Rep Steve Womack (R-Ark.) yesterday introduced the latest version of a Beer Institute-backed bill that would lower excise taxes on all brewers and beer importers.

The bipartisan Fair Brewers Excise and Economic Relief Act (Fair BEER Act), which was introduced into the House of Representatives yesterday morning, is co-sponsored by Rep. Ron Kind (D-Wis.) and differs from previous bills by creating a new scaled tax structure that would lower the per barrel tax rate for all brewers and importers of all sizes.

Prior iterations of the bill had included bigger breaks for small brewers, but wasn’t as “passable” in the eyes of the Beer Institute, said Chris Thorne, the vice president of communications for the BI. The latest reform bill would also keep the U.S. policy in line with the World Trade Organization, a key talking point the BI plans to deploy when it discusses the bill with members of Congress.

In a phone call with Brewbound, BI president Jim McGreevy explained that a “graduated federal excise tax structure” benefits small craft brewers, as well as large domestic and international beer companies, by slashing excise taxes at various levels of production, bringing down or eliminating the excise tax rate for production levels under 2 million.

Breaking It Down

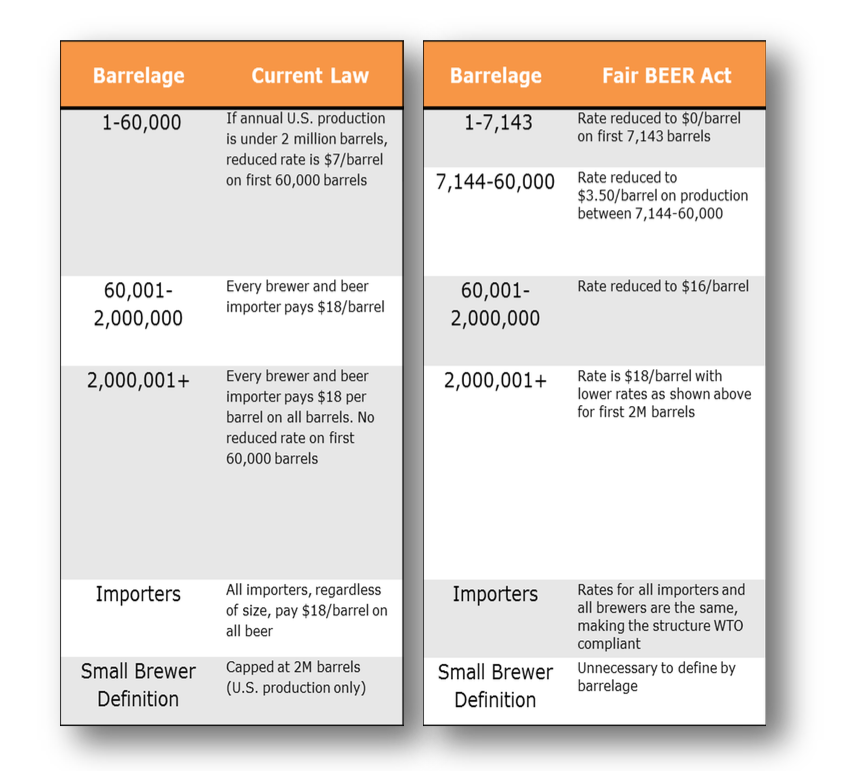

- As written, the Fair BEER Act would eliminate federal excise taxes for all beer companies on the first 7,143 barrels produced;

- All brewers and importers would pay $3.50 per barrel on the next 52,857 barrels (7,144 — 60,000);

- All brewers and importers would pay $16 per barrel on the next 1,940,000 barrels (60,001 – 2 million);

- All brewers and importers would pay $18 per barrel on every barrel above 2 million.

Under the current federal tax structure, a reduced rate of $7 per barrel is paid on the first 60,000 barrels of beer that are sold by brewers making less than 2 million barrels annually. Additional barrels, up to 2 million, are taxed at $18 per barrel. That’s the same rate at which domestic brewers making more than 2 million barrels annually, as well as all beer importers, currently pay for every barrel produced.

But the introduction of the Fair Beer Act bill hasn’t come without opposition, however. Before the BI could send out press release touting the benefits of the new bill, the Brewers Association issued its own statement, challenging the motives while simultaneously explaining the advantages of the competing Small BREW Act, which it supports.

“While the Brewers Association supports lowering excise taxes for small brewers, the BEER Act is not the way to do it,” BA CEO Bob Pease said in a press statement. “There are several problematic issues with this legislation including cost to the country, job creation and fairness. The BEER Act gives further tax advantages to multinational brewing companies that not only already pay lower rates than purely domestic brewers, but also have cut thousands of U.S. jobs in the past six years and export and shelter their U.S. profits.”

The BA’s Small BREW Act is intended to give preference to smaller producers while also attempting to redefine the federal definition of a small brewer, raising the production ceiling to 6 million barrels.

The two bill are actually quite similar. In its current form, the Small BREW Act would also cut the tax rate on a brewery’s first 60,000 barrels in half, from $7 to $3.50, and would also cut the excise tax rate from $18 per barrel to $16 for production between 60,001 and 2 million barrels. Once a brewery surpasses that 2 million barrel threshold, however, the federal excise tax would not change from the current $18 per barrel rate. The new rates, if signed into law, would be applicable to brewers with annual production of 6 million barrels or less, which the BA currently uses as part of its own definition of a “craft brewer.”

But McGreevy believes a bill aimed at including all brewers and beer importers, and one that is WTO-compliant, is a better approach.

“I think the Fair BEER Act, as it covers all brewers and beer importers, takes away a potential challenge that could come from other governments, and other brewers around the world, who could challenge a law that doesn’t include everyone,” said McGreevy. “We want to make sure that the potential challenge doesn’t exist if beer excise tax reform gets passed in Congress.”

A History of Reform

This isn’t the first time that either group has tried to reform the tax code. Versions of the BEER Act have been introduced into Congress since 1990, when the excise tax rate for larger brewers doubled from $9 to $18. At the time, the government maintained a reduced federal excise tax rate (which had gone into effect in 1976) of $7 on the first 60,000 barrels for brewers making less than 2 million annually.

But as the beer industry has evolved, the BA says, so has a need for additional reform.

While the BA has been pushing the same version of the Small BREW Act for years, the BI has chosen instead to lobby behind bills that were designed to prevent additional tax hikes, Thorne said.

In fact, in 2013, a version of the BEER Act that actually provided greater tax relief for small brewers (defined in the bill as those making less than 2 million barrels annually) was introduced into both the House and Senate. Under that proposal, small brewers would have paid no federal excise tax on the first 15,000 barrels; $3.50 for barrels 15,001 to 60,000 and $9 for every barrel over 60,000 up to 2 million. For brewers making more than 2 million barrels annually, and for all beer importers (regardless of size), the federal excise tax rate would have been $9 per barrel.

Mixed Messages

Past BI-backed bills, as well as the current “Fair BEER Act,” have always faced stiff opposition from the BA, however.

Nevertheless, the BI maintains that passing the Small BREW Act – which was recently reintroduced in the Senate – puts the U.S. at risk of violating WTO policies because its proposed scaled tax rate, as the bill is currently written, would not apply to beer importers.

The BI argues that the Small BREW Act, because of its preference to smaller U.S.-based breweries, is inconsistent with the requirement of the WTO’s “General Agreement on Tariffs and Trade 1994,” which does not allow WTO members to impose taxes on imported products that are “in excess” of those imposed on similar domestic products.

The U.S. is a member of the WTO and has free trade agreements with 20 countries, including Mexico and Canada, two of the largest importers of beer into the U.S.

The BA, for its part, has chosen to follow the money and is focusing its message on the cost of each bill.

According the BA, if the Fair BEER Act were to pass, more than $150 million in excise tax revenue would be lost. At least a portion of those savings would be sent abroad, the BA claims. The Small BREW Act, on the other hand, would only cost $64 million and those savings would stay in the U.S.

BA economist Bart Watson explained the math for Brewbound. By his calculations, one of the largest chunks of lost revenue would stem from 4 million barrels of import beer volumes that would receive significant tax reductions. Those barrels, currently being taxed at $18 per barrel, would be taxed at an average of $11 per barrel under the Fair BEER Act, he said.

“The vast majority of those [imported barrels] are small,” he said, noting that most countries import less than 60,000 barrels annually.

Indeed, according to the Beer Institute figures, only 12 countries import more than 60,000 barrels annually. And by Watson’s estimates, as much as $70 million worth of import excise tax would be lost under the Fair BEER Act, though he has “conservatively” budgeted $45 million.

Additionally, by Watson’s calculations, there are about 30 million barrels of beer made by breweries producing less than 6 million annually. That cost, he said, could total more than $80 million.

The BI disputed those statistics, claiming that the total cost would be closer to $113 million. To calculate its estimate, the BI looked at 2013 production volumes, taxes paid on those volumes, and compared the savings under the proposed BEER Act.

Nonetheless, both the BA and the BI have been able to agree on one thing: Both groups feel that a unified voice in Washington D.C. would improve the chances of passing any bill. But they still have been unable to come to terms on a single proposal, McGreevy said.

“The BA board and the BI board had some discussion over the summer about finding a way to get to one bill,” said McGreevy. “It didn’t happen at the time. I think there are plenty of places where the BA and BI can work together on regulatory issues. This isn’t one of them right now but its doesn’t mean that it couldn’t be one in the future.”

Last time around, the Small Brew Act received support from 182 House members and 47 senators. The BEER Act, which is vastly different than this year’s version, had 114 supporters in the House and only 12 in the Senate.