The average U.S. consumer will spend $99 on a 10-person barbecue this summer, with a significant portion of that cost coming from bev-alc and soda, according to analysts from Rabobank, a financial services company.

Analysts dove into BBQ spending habits and inflation during a webinar Wednesday, ahead of next week’s July 4 holiday.

2024 will likely be the last year that a 10-person BBQ costs less than $100 on average, according to executive director and senior consumer foods analyst Tom Bailey. This year’s costs increased +2% versus 2022.

“While at face value +2% seems modest, it comes after [a] +29% increase in overall costs for our barbecues since 2019,” Bailey said. “So the incremental inflation has aggregated to +29% since 2019. We’re adding on another +2%, and that +2% is very weighty.”

Nearly 40% of the total costs for having a BBQ is expected to be from beverages, including bev-alc and sodas. Beer alone is expected to be more than 25% of consumers’ total spend.

With beer taking up such a large portion of total spend, costs are even more weighted by price increases in beer. Meanwhile, beer has been outpacing other beverage categories in inflation, according to Consumer Price Index (CPI) reports from the Bureau of Labor Statistics (BLS), creating even more impact from bev-alc on the overall costs rise.

Beer has consistently outpriced wine and spirits since InBev’s acquisition of Anheuser-Busch, marking a 15-year trend, according to Rabobank senior analyst, beverages, Jim Watson. While beer consumers can deal with a price dynamic change for a short period of time, 15 years is hard to sustain, he added. Additionally, it’s changed how consumers think about beer – particularly the youngest legal-drinking-age consumers.

“You’ve created something where there’s now perhaps a generational difference in how you view these categories,” Watson said. “The new generation coming into beer is coming into it with a completely different pricing landscape than one or two generations ago.”

In the May CPI, the latest report available from the BLS, beer at home increased +3.1% year-over-year (YoY), rising just enough to end six consecutive months of the category posting a CPI reading at or below +3%, before seasonal adjustment. Beer inflation was below increases for all items (+3.3%), but was above spirits (+0.6%), wine (+0.1%) and total bev-alc (1.4%) at home, before seasonal adjustment.

Consumers are also starting to get wary of price again, which could continue to impact beer. “Consumer Confidence” – a measurement of how confident consumers are in the economy, recorded by the Conference Board – fell from 101.3 in May, to 100.4 in June, MarketWatch reported this week. In June 2023, consumer confidence was 98.4, and fell to 95.3 by July, but stayed above those levels for the rest of the year.

Additionally, the confidence gauge – the Conference Board’s six-month projection – declined from 74.9 in May to 73 in June, marking a 13-month low, according to MarketWatch.

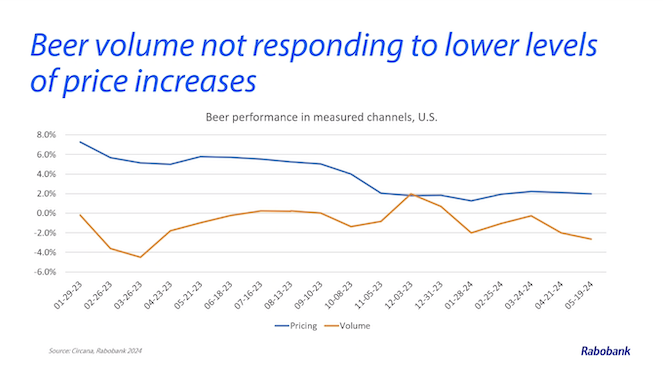

While beer companies could lower prices, recent history suggests that consumers are unlikely to significantly change their spending habits, according to Watson. For example, beer pricing fell below +2% in Circana-tracked channels at the end of January 2024 – after spending most of 2023 above +4% – but beer volume also declined to -2%, its lowest volume growth level since early 2023.

“The beer industry itself has a number of structural problems and consumption problems that’s reflected in that data,” Watson said. “The fact that you’re taking that level of price increasing down quite a lot, and the consumers are not responding … it reflects a real weak consumer.”