With changing demographics and drinking habits, and as inflation and desire for convenience shifts shopping patterns, suppliers should view ready-to-drink (RTD) offerings as a unique mega category, according to a new report from NIQ.

As wine, spirits and beer struggle to find growth outside of RTDs, the report highlights how a drive toward flavor and friction-free shopping is altering household spending, and what the opportunities at retail are for each subsegment of the 4th category.

RTD Drivers: Demographics, Cost of Living, Portability

What’s driving the rapid growth of RTDs? One major factor is the rising cost of living. Nearly one-third (32%) of Americans are worse off financially than a year ago, with 74% saying it’s due to the high cost of living, according to NIQ’s consumer outlook survey from December 2023. Almost half (44%) of consumers say if prices continue to rise they will cut back on bev-alc purchases. But that doesn’t mean they’re hunting deals: Only 10% will stock up on bev-alc when on promotion and only 6% say they will switch to a private label product.

However, friction-free retail is more important than price: Bev-alc consumers tend to favor speed of purchase more than any other shopping aspect. Nearly half (44%) of shoppers say convenient location is the top attribute chosen when shopping for bev-alc products. Along those same lines, portability is driving shoppers to RTDs with can and single-serve formats dominating dollars. Within spirits-based RTDs almost $8 out of every $10 spent is on the can format; for beer, FMB, and cider nearly $7 of every $10 spent is on the can format.

The report also highlighted that with Gen Z driving trends, RTDs with lower calories and lower sugar are capturing mindful drinking aspirations, meaning anything from product transparency to moderation. Bev-alc products labeled with “eco friendly certified” are increasing dollar sales 28% versus a year ago, outpacing category growth. Authenticity and diversity are also part of the changing demographics, so a consumer recruitment strategy that adapts to “embrace ethnic diverse groups and the diversity inherent in them,” is key for the category’s growth.

Flavor, Trial Creating Blurred Categories

Consumers are concerned less about the alcohol base of RTDs and are instead drawn to their flavors, cocktail varieties, and the convenience of consumption they offer, according to the report. As a result there’s now more overlap than there has been historically of households purchasing all three categories. Households purchasing overlapping products from all four categories are now responsible for 29% of overall bev-alc volume.

“Overlapping households are typically open to new product concepts, have heavy bev-alc

purchasing metrics, and welcome additions to their lifestyles,” read the report.

That interest in trial is making extended loyalty harder to come by, and the fragmentation of categories may be creating shopper fatigue. Wine (-4%), spirits (-1.1%), beer/cider (-3.2%), excluding RTDs, are down in volume over the last 52-week period through March 30, compared to the same period a year prior, in off-premise retailers tracked by NIQ.

FMBs, Spirits-Based RTDs Lead

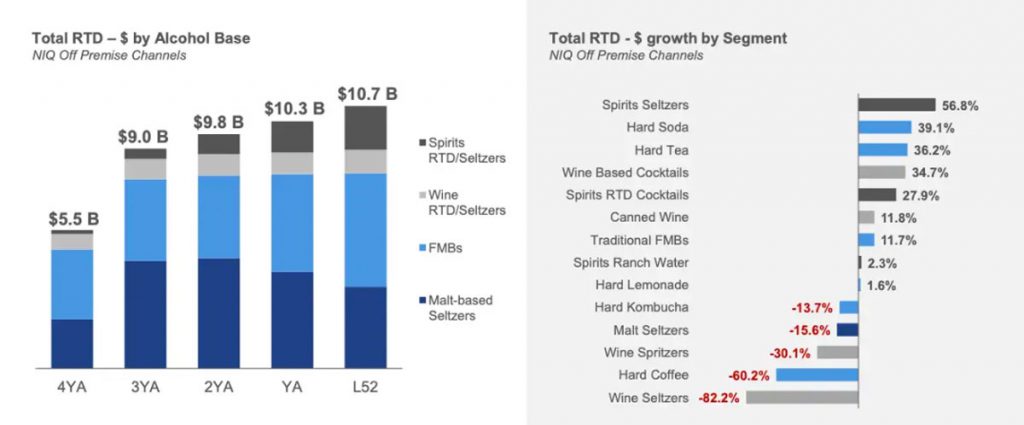

FMBs and spirits-based RTDs are acquiring more shelf space and increasing consumer takeaway, according to the report. Segments in order of off-premise dollar share in the last 52 weeks ending March 30:

- FMBs: 43.9% of share, with sales up +16%

- Hard Seltzer 32.5%, with sales down -15.6%

- Spirits: 16.9%, with sales up +40%

- Wine: 9.1% of share, wth sales up +9.2%

Spirits-based RTDs and FMBs are driving growth of the $10.7 billion category, with spirits-based seltzers (+56.8%), hard soda (+39.1%), hard tea (+36.2%), wine-based cocktails (+34.7%), and spirits cocktails (+27.9%) leading dollar growth since compared to the same reporting period last year. Hard kombucha (-13.7%), malt seltzers (-15.6%), wine spritzers (-30.1%), hard coffee (-60.2%) and wine seltzers (-82.2%) were all down.

The impact of RTDs on each category varies. For beer, as FMBs grow, RTDs are trending in very unique directions compared to traditional beer segments. Retailers have been using RTDs in promotional rotation, “giving big brands continued visibility via subsidization” and RTDs have moved at a “unique pace for front line price increases with distinctive thresholds and gaps to other beer products.” Consumers are fueling the shift between seltzers to FMB, creating “a unique flavor driven repertoire of personal consumption,” read the report.

As for spirits, traditional spirits are struggling with losing out to RTDs: Tequila and whiskey are holding onto some strength with consumer loyalty, but RTDs are building on a small but growing base. Promotional activity and shopper subsidization is the highest for RTDs compared to spirits, as retailers look to drive traffic and volume. The days between purchases are shortening for RTDs too and increasing for all other spirits, which could become much more problematic through the middle of the year.

Meanwhile in wine, RTDs can serve as a bridge into still wine with the report recommending that still and sparkling can benefit by testing a closer association to RTD, including packaging and taking a more approachable stance.