After a tumultuous year, the beer industry is expected to finish 2020 down by 0.5% in volume, according to National Beer Wholesalers Association (NBWA) chief economist Lester Jones.

“Despite losing all this keg volume and all this on-premise, having 20% of the on-premise market shut down basically for a certain period of time, having fewer establishments, fewer occasions, the beer market in total is going to look a lot like it has in previous years,” Jones said. “It just means a whole bunch of beer got shifted around.”

Factoring in data from the NBWA, the Alcohol and Tobacco Tax and Trade Bureau (TTB) and the U.S. Department of Commerce, Jones estimates that 1 million fewer barrels of domestic and imported beer, cider and flavored malt beverages (FMB) will be sold in 2020 compared to 2019.

In a presentation with Fintech director of distributors Jim Kallies, Jones recapped beer industry performance in 2020, which the two dubbed “beer’s most interesting year.” While a decline of less than 1% may seem benign, the “radical shift to [a] different consumption pattern” has vast implications for some suppliers, such as most small craft breweries, and on-premise retailers, Jones said.

Since March, when stay-home orders went into effect in many states to stop the spread of COVID-19, the shutdown of on-premise venues and cancellation of in-person events has led to “fewers establishments and fewer occasions [which] funnel consumers into fewer buying opportunities,” Jones wrote on presentation slides.

On-Premise Carnage

In a typical year, kegs account for about 10% of all distributed beer. Between Week 12 and Week 20, they fell to 0% and in some cases trended negative, due to widespread on-premise shutdowns.

“A lot of beer spoiled in on-premise trades — stadiums, restaurants, concessionaire venues — and that beer had to be actually pulled out, so that actually came out as a negative in Fintech data,” Jones said.

When on-premise establishments began to reopen around Week 21, draft beer began to tick up slightly, but will finish the year accounting for 3% of all packaged distributed beer. The share vacated by kegs went to cans, with that package’s share up 5%, to 65%. Bottles’ share has remained steady at 32%, even as the nation’s can supply has tightened.

So far, 18,364 on-premise retailers that sell beer have closed, the vast majority of which are independent, non-chain outlets, according to TDLinx. The on-premise segment that has performed the best through Week 50 is golf courses and country clubs, which have sold nearly 90% of their 2019 volumes, according to Fintech data. Sports bars, private clubs, restaurants, bars/taverns and casinos have sold between 60-70% of their 2019 volumes. Hotels, fine dining restaurants, airports and other transit hubs and stadiums are less than halfway to their 2019 beer volumes.

“The transportation, the fine dining, the concessions are really taking the brunt of this impact,” Jones said.

Beer sales have increased though in one on-premise channel: fast casual restaurants.

“That’s people grabbing and going,” Jones said. “They do have beer, but they’re grabbing one beer — they’re not staying around for two. That’s not good for having sessions of multiple beer sales.”

Craft Segment Share Shifts

The craft beer suppliers that gained the most market share in 2020 fall outside the Brewers Association’s definition of a craft brewer. Anheuser-Busch InBev’s Brewers Collective, the company’s craft division, and Mahou San Miguel-owned Founders Brewing Company each gained 0.4 sharepoints this year. Founders gained 1.1 sharepoints in 2019, for an increase of 1.5 sharepoints in two years.

Craft beer suppliers that lost the most share in 2020 were Molson Coors Beverage Company — craft offerings include Blue Moon, Leinenkugel’s and regional players Terrapin, Hop Valley, Revolver, Saint Archer and Revolver — and Boston Beer Company, which each lost 1.4 sharepoints in 2020. Last year, Molson Coors lost 2.7 sharepoints and Boston Beer lost 2.9 sharepoints.

Boston Beer’s losses can be attributed to Samuel Adams, which lost 1.4 sharepoints in 2020 and 2.9 sharepoints in 2019 in craft styles. Molson Coors’ craft style share losses are coming from Leininkugel’s, which lost 0.7 sharepoints in 2020, and Blue Moon, which lost 0.9 sharepoints in 2020.

“This is one of those brands that was over-indexed in draft beer, so not a shock that it’s struggling in 2020,” Jones said of Blue Moon.

Other leading craft brand families’ share held more or less steady in 2020:

- New Belgium, +0.2 sharepoints;

- Sierra Nevada, +0.2 sharepoints;

- Shiner, -0.4 sharepoints;

- Founders, +0.4 sharepoints;

- Lagunitas, -0.4 sharepoints;

- Bell’s, +0.2 sharepoints;

- Kona, -0.2 sharepoints.

FMBs and Hard Seltzers Capture Share

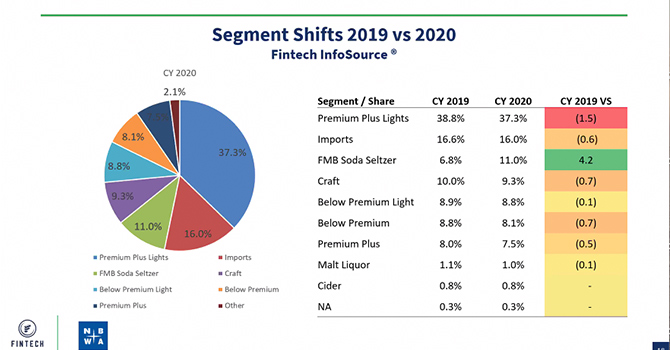

FMBs were the only beer category segment to gain share in 2020, ending the year up 4.2 sharepoints.

“Seltzers and FMBs grabbed a big share of the market,” Jones said.

Premium lights lost the most share, declining 1.5 sharepoints. Most other segments declined as well — imports (-0.6 sharepoints), craft (-0.7 sharepoints), below premium lights (-0.1 sharepoints), below premium (-0.7 sharepoints), premium plus (-0.5 sharepoints), malt liquor (-0.1 sharepoints). Cider and non-alcoholic beer’s share held steady at 0.8% and 0.3%, respectively.

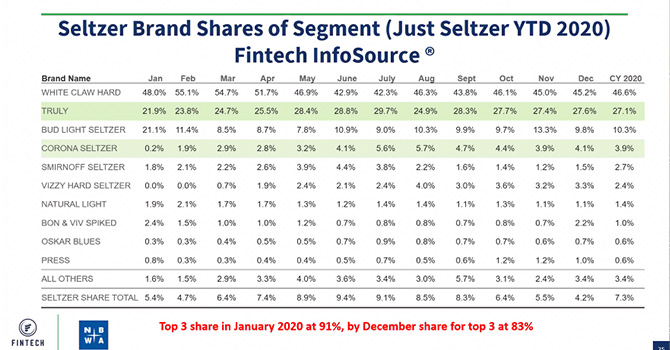

The hard seltzer segment has long been dominated by two lead brands, White Claw (Mark Anthony Brands) and Truly Hard Seltzer (Boston Beer). In January 2020, A-B introduced Bud Light Seltzer, which has been the only new entrant to the segment to crack double-digits in share.

Together, these three held 91% of the segment’s share in January. But after new releases and a summer of persistent out-of-stock issues, that declined to 83% in December. In the months between, only Truly gained share, with 21.9% of seltzer sales in January and 27.6% in December.

In January, White Claw accounted for 48% of hard seltzer sales and Bud Light accounted for 21.1%, according to Fintech data. In December, White Claw accounts for 45.2%. Bud Light, however, lost more than half its share, with 10.3% of seltzer sales in December.

“This is more of distributors supplying retailers, not consumers pulling it out,” Jones said of Bud Light Seltzer’s decline over the year.