Independence matters to craft beer drinkers.

During Thursday morning’s New York version of the Brewbound Session, Nielsen senior vice president of beverage alcohol practice Danny Brager and associate client manager Caitlyn Battaglia revealed the findings of a new 2,000-person Harris Poll survey co-developed by Brewbound and Nielsen examining whether 29 popular buzzwords used to market beer are resonating with regular craft beer drinkers.

The results showed that 81 percent of craft beer consumers were familiar with the terms “independent” and “independently owned.” The next most recognized word to beer drinkers: “traditional.”

That’s good news for the Brewers Association, which defines a craft brewer as being small (less than 6 million barrels), independent (less than 25 percent owned or controlled by an alcoholic industry member that is not themselves a craft brewer) and traditional (a majority of beer volume is made using traditional or innovative brewing ingredients; FMBs are not considered beers).

In fact, the finding echoed a speech given by Allagash founder Rob Tod, who serves as the chair of the BA board of directors, earlier this year during the annual Craft Brewers Conference in Washington, D.C.

“We should be gravely concerned when we hear themes like ‘independence does not matter to the beer drinker,’” he said.

More importantly for beer companies, the term “independent,” “independently owned” and “traditional” are helping drive purchasing decisions and clearly have cachet with consumers, Brager told Brewbound.

Even though consumers say they understand the terms “independent” and “independently owned,” there remains the question of whether they actually know about ownership changes and if those would actually affect their purchasing decisions, Brager said. For example, did consumers who said they would stop purchasing Wicked Weed’s beer following Anheuser-Busch InBev’s acquisition of the Asheville, North Carolina, brewery actually follow through with that promise. Even so, if a brewery operates outside of its parent company, it may matter to consumers.

“If the brewery is still operated independently, that might have some cache with the consumer,” Brager added.

However, in some not-so-good news for the BA, the acronym for the Great American Beer Fest, GABF, was the least recognizable term, with just 19 percent of respondents saying they were familiar with the reference to the largest beer fest and competition in the United States.

“Don’t assume that acronyms and initials mean something to everybody,” Brager cautioned.

Consumers also said they were most familiar with the terms “hoppy,” “drinkable” and “limited edition,” “citrus/citrusy” and “barrel-aged.”

However, “Brett,” “funky,” “grassy,” “Mosaic,” “juicy,” “hazy,” “smoked” and “collaboration” were among the least understood terms.

“The awareness levels were all over the place,” Brager told Brewbound. “Just throwing a bunch of words against the wall and hoping that something sticks, that may or may not be the best thing as opposed to recognizing which ones really stick and playing heavily on those words and educating people on the other ones.”

In all, 23 of the 29 words in the survey helped drive purchasing decisions with the top terms being “drinkable,” “independently owned,” “limited edition” and “West Coast IPA.”

“For craft brewers, [they need] to recognize that while sometimes they use a lot of terms in their marketing and talking to consumers, in many cases some of those terms have a low-level of awareness and they may not have the positive influences on purchases,” Brager said.

For the terms that don’t resonate, Brager said there needs to be more continual education on the terms.

“When they know about it, they are more likely to purchase it,” he said.

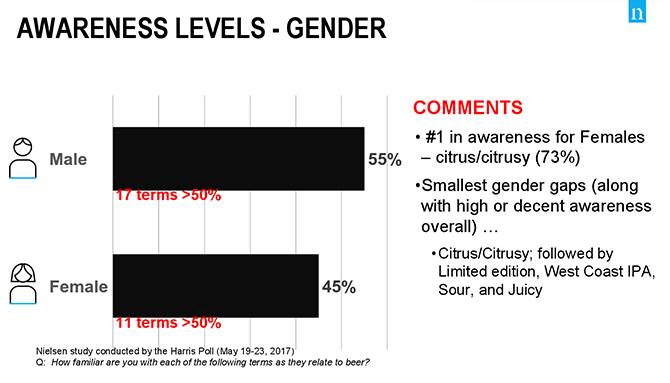

Only six terms — “citrus/citrusy,” “limited edition,” “West Coast IPA,” “sour” and “juicy” — had a balanced purchasing influence between men and women. The study showed that female consumers were most familiar with the term “citrus/citrusy,” with 73 percent of the women polled saying they understood the term.

“Maybe females don’t care as much,” Brager said of the terms. “The females who answered this claim they drink craft beer regularly. So either they don’t care that much about it or marketers need to do a better job of reaching out to female audiences and helping them understand some of these terms.

“The flavors seem to mean more [to women],” Brager added, “than maybe some of the more technical terms. Just a guess.”

Although the “sour” style of beer is seeing “popular sales trends,” the style term proved polarizing among consumers who said they would be less likely to make a purchase after seeing the descriptor, Brager said.

“With terms like ‘sour’ or ‘funky,’ off the top, that may not be the most endearing term that somebody could use for any kind of product,” Brager said. “I think that may be a negative factor to begin with. That doesn’t mean then that people that you can get to try it won’t like it. There’s a growing number of people, albeit small, because when we look at the sales data, it’s definitely growing, but it’s still a relatively small piece of the market.”

Also a turnoff for drinkers: “piney” and “hazy.”

Even though consumers polled said they weren’t familiar with “juicy” and “hazy,” they did say they were aware of the meaning of “New England style,” in reference to the popular cloudy IPAs being produced in the Northeast.

Breaking down the data into age groups, 66 percent of 21- to 34-year-old consumers were familiar with the terms in the study. The least familiar: People 65 years old and older, who had just a 33 percent familiarity with the terms.

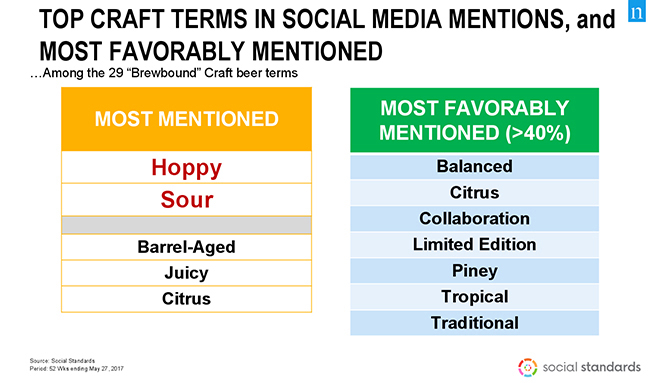

Nielsen also examined the chatter on social media surrounding the industry with the help of Social Standards, a company that monitors social media analytics for brands. And there’s a lot of talk about craft beer online with craft accounting for 21 percent of all beer conversations on Instagram and Twitter with Stone Brewing, New Belgium, Dogfish Head, Founders, Yuengling and Firestone Walker being the most discussed breweries.

“People talk about craft beer in larger proportions than craft beer’s sales share,” Brager said. “It’s also a place where people can be educated.”

Of the 29 terms analyzed in the study, “hoppy” and “sour” were by far the most discussed craft beer terms on social media. However, the most positive discussions revolved around the terms “balanced,” “citrus,” “collaboration,” “limited edition,” “piney,” “tropical” and “traditional.”