Two of the largest U.S. states now boast a record number of breweries.

According to an economic impact study released Tuesday by the California Craft Brewers Association (CCBA) — a nonprofit trade group that represents the interests of the state’s craft brewers — California continues to be home to the most breweries in the nation, with more than 980 in operation as of April 2019.

Meanwhile, an economic impact study released today by the New York State Brewers Association (NYSBA), found that 434 craft breweries were operating in the Empire State at the end of 2018, up from 383 in 2017.

The CCBA’s study, which combined internal data with Brewers Association statistics from 2017, the last year for which complete data was available, reported that California’s 908 craft breweries that were operating at the time grew production to about 3.3 million barrels that year.

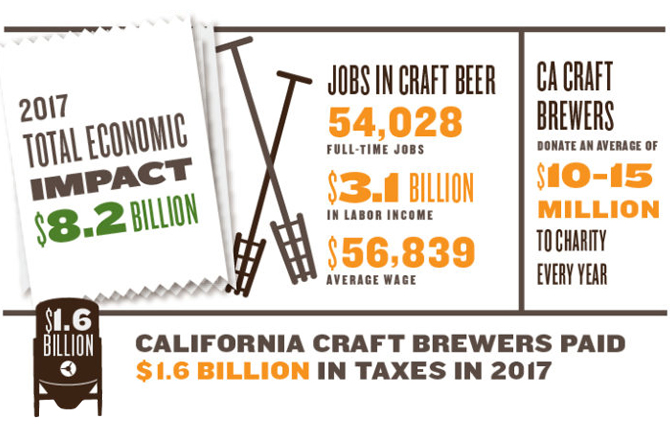

Also in 2017, California’s craft breweries contributed more than $8.2 billion in economic impact to the state, the CCBA reported. Speaking to Brewbound, CCBA executive director Tom McCormick said California craft breweries’ economic impact has tripled over the last five years.

McCormick also noted that “98 percent of the value” of its study is to show state lawmakers the importance of the craft brewing industry. He added that the trade organization doesn’t have a political action committee and doesn’t “pay-to-play” with lawmakers.

“All the other stakeholders in the industry do, some significantly,” he said. “And when we go to state our case on any particular issue at the state Capitol, we are up against that. Let’s not pretend that Anheuser-Busch and the wholesalers don’t pay a whole lot of money in campaign contributions every year for fun. They do it to buy influence and it works.”

The California legislative session is currently underway, and McCormick said there are a number of issues that could negatively affect the state’s craft breweries, including an effort by wholesalers to enact strict franchise laws, and an attempt by Anheuser-Busch to allow beer companies to give away glassware. There’s also an effort to lower the blood-alcohol limit for drunk driving offenses to 0.05.

Being able to show lawmakers the financial impact of the craft brewing industry can help even the playing field and sway decision makers, McCormick said.

“I lay this out and walk through it very carefully and show them that we are a significant part of the state’s economy and there are 908 constituents out there,” McCormick said, referring to the number of breweries in operation in 2017.

Although California’s brewery opening trends continue to be stronger than other states, McCormick said the state has “seen a notable decrease in the rate of new brewery openings.”

Many breweries that are opening in the state are doing so in pockets where few breweries exist, such as the Foothills, Sierra, Central Valley and outlying areas of the Bay Area, McCormick said. However, finding those pockets is increasingly more difficult as 95 percent of the state’s 39.5 million residents now live within 10 miles of a brewery.

For his part, New York State Brewers Association executive director Paul Leone attributed the craft brewing industry’s growth in the Empire State to support from Gov. Andrew Cuomo and lawmakers, as well as pro-craft legislation — including a 2014 modernization act that permitted direct-to-consumer sales at brewery taprooms as well as a farm brewery bill that allowed breweries to open up to five satellite tasting rooms.

“The controversies in Texas and New Jersey and Connecticut and I could go on and on … they make it difficult for breweries to operate,” he said. “And that doesn’t happen in this state. We’re also a state of 20 million people, so we certainly have the population here to support the number of breweries.”

New York craft breweries produced 2 million barrels of beer in 2018, according to the NYSBA’s study, which was conducted by independent economics firm John Dunham & Associates. In 2018, those breweries generated $5.4 billion in total economic impact and $3.5 million in direct impact from all three theirs (brewers, wholesalers and retailers) as well as tourism.

Leone said the majority of the growth is coming from small breweries that sell the bulk of their beer through their taprooms.

“When I started this job in 2013 there were 135 breweries,” he said, adding that now one brewery opens about every eight days in the state.

“We’re in the top 10 in barrels, economic impact and the number of breweries,” he added.

Leone added that New York could cross the 500 brewery threshold “comfortably” in the coming years, as there are125 breweries-in-planning. Currently, he said, the fastest growing regions for breweries are in the Rochester/Finger Lakes, Hudson Valley and Long Island areas.