On-premise retailers can be the gateway for craft breweries looking to establish a strong brand presence in their local markets, but only when they are provided with well-made, well-marketed products that justify switching a tap-handle from an outside brand.

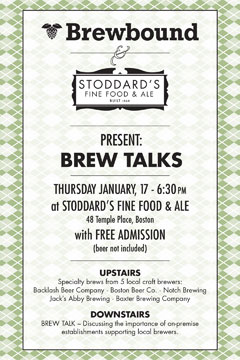

That challenge, getting a bar or restaurant to go for a local brand in the face of offerings from larger or better-known brewers, was discussed during Brewbound.com’s first of a series of “Brew Talks.” This one was held on Jan. 17 at craft-centric Boston beer bar Stoddard’s Fine Food and Ale.

Lohring contended that there are enough local brands to satisfy demand, and enough interested consumers to justify the existence of those local brands, but there is a squeeze in the middle.

“The problem is that there is a pipeline between those two that is very constricting,” he said, “And that pipeline is wholesalers and retailers. I feel that the amount of brands in Massachusetts can continue to grow if one thing happens: if that pipeline gets dedicated to more beer that is locally produced.”

That metaphorical pipeline runs to real tap-handles, but the problem is that those taps are also targeted by both well-known out-of-state craft brands and also large beer companies, some with craft-like offerings, who have both pricing advantages and the ability to offer free cash or promotions to on-premise accounts who allocate taps on a “pay-to-play” basis.

With those obstacles present, Lohring suggested that local craft brewers — including him — need to do a better job of creating consumer demand for their products.

“It’s going to be a tough challenge for a lot of us to get that brand recognition and pull that we require to be a growing business,” he said.

Wholesalers can help create that demand, Murphy said, by promoting local brands. But, Martin said, retailers need to have a logical local substitute.

“The key word is replacing,” Martin said. “Taking something away like an easy drinking Miller Lite and replacing it with something like a Notch Session is what makes it work. Whatever it may be, you have to have some sort of replacement.”

And that changeover won’t stick if there’s a lack of fresh and timely delivery.

“My biggest concern is supply,” Martin said. “You know that when you call AB [Anheuser-Busch] or MillerCoors, they are always going to have product.”

Lohring agreed, admitting that when he first earned a draught placement at Eastern Standard, forecasting demand without any sales history was a struggle.

Some New England brewers are also struggling with consistency and quality, the panelists said, which can make it hard to justify the change.

“I’ve tasted some bad local beers,” said Martin. “I can appreciate local and the [different] styles, but you can’t expect to sell a beer just because it’s made locally. It’s got to be good.”

“There are a lot of people trying to get into this industry now and ‘ride the coattails’ so to speak,” Murphy added. “And we just hope that those guys don’t make it to market because it could put a damper on all of the guys that are in this room right now doing legit beers.”

But bars and restaurants suffer from legitimacy issues as well, particularly when they sell taphandles. None of the panelists could offer proven strategies to win over those “pay-to-play” accounts, but Lohring said that those establishments aren’t necessarily for local brewers, anyway.

“The account that has their hand out when you walk in the door is the last account you want to be in,” he said.

One developing issue the panel discussed is a shift to the rotational draught model. Under this scheme, many craft beer bar owners are focused on moving more kinds of different beer through their bars. While that encourages sampling, it also means that local beer producers can have a harder time developing repeat consumer business.

In the case of heavy rotation, Lohring said, it’s up to the producer to decide the importance of the retail account.

“It’s the retailer’s prerogative to sell beer the way they want to sell it and we need to fit ourselves into that method,” said Lohring. “If we don’t like [it], too bad. We can go out of business or we can adapt to the way beer is being sold now on-premise and try to figure out a way to make that work.”